Goldco Review: What You Need To Know!

Disclosure: The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.

While Goldco is known as a precious metals broker, they also work with the Gold IRA custodian customers and companies to set up new accounts while providing gold ira rollovers services for customers that wish to transfer funds in an IRA from another financial institution or company into a self-directed precious metal IRA.

Trevor Gerszt is the founder of Goldco. Inc. Magazine named Goldco the third of the fastest-growing financial services companies in the US back in 2015, while the Los Angeles Business Journal did name it as the 17th fastest-growing ira company within the greater Los Angeles Area.

The Bottom Line: Goldco is one of the best providers of precious metals IRA's in the market today. They are known for excellent customer service and effective diversification strategies that help individuals with their retirement accounts.

Pros & Cons

Pros:

Cons:

Precious metals and gold IRAS are investments that carry risk. Consumers must be aware of claims that are made that customers make a significant profit with this type of investment with minimal risk. Similar to any other type of investment, it is possible to lose money, while past performance won't always guarantee performance results in the future. Consumers should also investigate and understand any fee linked with an investment before they agree to invest.

How To Invest With Goldco

Investing in one of the Precious Metals IRAs is one of the best options for customers that are unsure about the volatility surrounding the bond and stock markets. Precious Metals IRAs are also appealing to consumers that want tangible items for an investment as opposed to a percentage of a business that could disappear altogether or make changes in mergers.

Goldco offers brokerage services and advice for IRAs that are precious metals-funded under the IRS (Internal Revenue Service) rules. They are also in the business of buying back precious metals or selling them on the metal markets when a customer starts to distribute from their IRA. But Gold co doesn't provide storage or custodian services, but they can help clients to set up these services through the vendors they recommend.

Goldco is one of the companies that stands out when it comes to their impressive growth and national recognition. They have also been ranked by Inc. Magazine in 2015, 2016, and 2017, on their Inc. 5000 list for the 5000 fastest-growing private firms across the country. In 2017, Goldco ranked 670th with a revenue of $89.5 million and an impressive 676.77% growth rate.

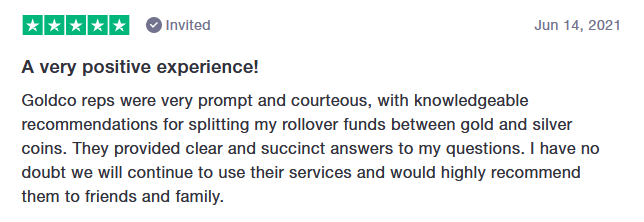

Goldco Complaints And Reviews

Current Goldco client testimonials, mostly have positive things to say in the reviews they leave about the company, the products that they provide, and customer service. ConsumerAffairs has shown 4.8 out of 5 stars for Goldco derived from 435 reviews, while the BBB has shown 4.9 stars derived from 128 reviews. Customers, in particular, talk about their satisfaction in association with the way Goldco deals with all the paperwork when it comes to the purchase between the IRA custodian and a storage facility in order to complete transactions. This helps the customer to avoid having to deal with multiple entities.

Most of the negative reviews (very few) have to do with a misunderstanding of how the precious metals markets work, and how the values are worked out or calculated. One of the more common complaints has to do with "collectible gold coin value". When buying collectible gold coins the value listed in the IRA corresponds with the "melt value", which translates to the worth of melted metal. This can lead to confusion, which is why Gold co explains to each customer that the value of the coin is separate and won't reflect the value of solid coins or the current market store of value. When the customers are provided with an explanation, a few of the negative reviews have been changed to a higher rating since they now have a better understanding of how the valuation works.

Goldco Services

The Goldco Precious Metal IRA products are split between Silver IRAs and Gold IRAs. It becomes important to understand that Goldco is only acting as the broker when it comes to selling and helping their clients buy silver, gold and other precious metals. They are not the custodian, yet they can help you to complete the paperwork for your account application with your chosen custodian company. Goldco helps customers to purchase IRS-approved bullion and coins that can be included in their Precious Metals IRAs and coordinate such purchases with the storage and custodian facility of the client. They can also help you if you want to roll over an existing retirement account into one of the Precious Metals IRAs. Here is a comprehensive list of the products that Goldco offers:

Gold IRA

Goldco offers information on how to open a Gold IRA, and the metals you are allowed to invest in.

Silver IRA

If you are not sure about how to go about starting a Silver IRA, Goldco provides tips and advice on the right way to start, and the silver coins that are accepted.

401(k) Rollover

Goldco assists with Gold rollover, direct rollover, indirect rollover or rolling over a traditional or another IRA type into a Precious Metals IRA.

Traditional or Roth IRA Planning

Goldco provides an extensive knowledge base and resources when comparing a Traditional and a Roth IRA, and they can also assist you if you decide to roll them into a Precious Metals IRA.

SEP IRA Planning

When you are looking for clarification or more information on SEP IRAs, Goldco offers information on aspects such as contribution limits and eligibility requirements.

Simple IRA Planning

Goldco gives you the information that you need on the way to open Simple IRAs along with how all the rules work when it comes to a gold or silver IRA.

Goldco Prices

For an investment of at least $25,000, Goldco will reimburse the storage fees over a year, by shipping the client silver coins, that are equal to the cost of the storage fees. It is important to be aware that silver does not form a portion of an account holder's IRA, which means the account holders are required to pay the fees of the storage company upfront.

At the $25,000 investment level, Goldco charges an annual fee of $175. For every additional $25,000 invested, Goldo will ship like-value silver for the next year to cover the storage fees directly to the holder of the account. Goldco does not increase its fees until the $100,000 investment level has been reached. From here the fee will increase to $225 annually.

- The Minimum Purchase Required: $25,000 is the recommended minimum

- The annual fee is $175, and will only increase to $225, once the $100,000 investment level has been reached.

- The Storage Fees will depend on the Custodian, but Goldco will reimburse the account holder one year's worth of "storage fees" for every $25,000 invested in a "like-value" silver form, which cannot be included in the IRA holdings.

- The Custodian Fee will vary from one custodian company to the next.

- The metals available include IRS-approved coins such as the Maple Leaf, american eagles and bullion coins in silver, gold, palladium, and platinum.

Since the gold prices fluctuate daily, the Goldco website displays charts that contain live palladium, platinum, silver, and gold prices within the United States.

Gold IRA Fees

The required minimum purchase at Goldco to start a gold IRA is $25,000. Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50, as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually. Goldco does not charge any storage fees for cash transactions over $25,000.

The company aims to save customers as much money as possible through its use of an "as low as" fee model.

The tables provided below will break down fees for Goldco precious metal IRAs as well as non-IRA transactions.

Goldco Fees Applicable For Precious Metal IRAs

One-Time Fees:

Price:

IRA Set-up fee

$50

Wire fee

$30

Yearly Fees:

Price:

Maintenance fee

$100

Storage fee

$100 (Applies for non-segregated)

or $150 (Applies for segregated)

Precious metal IRAs normally start out at $260 per year.

If you are interested in an IRA with non-segregated storage (the Goldco’s preferred method), it usually costs $260 for your first year and then after that $180 every year .

If you are interested in an IRA with segregated storage, it costs an extra $50. You will be required to pay $310 for the first year and then for the following years $230.

Goldco Fees Applicable For Non-IRA Transactions

One-time set-up fees

$0

Yearly maintenance fees

$0

Storage fees

$0

That’s correct… zero fees will apply for the non-IRA transactions.

Investment Minimums

If you are wondering how much retirement funds you will need for you to be able to invest with Goldco, the chart provided below lists the fees for both IRA as well as non-IRA transactions:

Goldco Investment Minimums

Precious Metal IRAs

$25,000

Non-IRA Transactions

$3,500

How To Get A Gold Precious Metals IRA Started

To start your Precious Metals IRA, you can either directly call Goldco or you can fill in the online application. Similar to any other type of financial account, identifiable information like your social security number is required while establishing your account. If you don't have your own custodian precious metals company, Goldco will help you set up your account with a custodian company that they recommend.

Goldco will also email or mail you a complete guide that explains the different options for investing with precious metals so that you can review everything before you make a decision on the type of metals you want to put into your IRA.

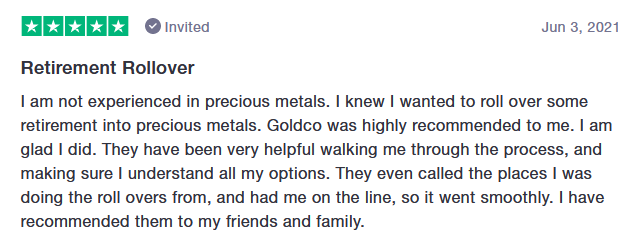

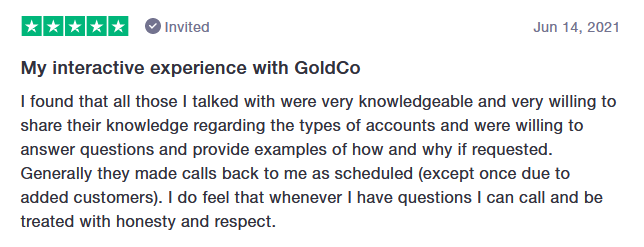

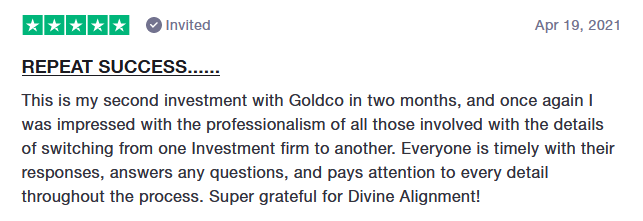

What Do Goldco Customers Say?

|  |

|  |

|  |

Goldco Questions And Answers (Individual Retirement Account IRA FAQ)

The minimum investment level is set at $25,000

Gold, Silver, Palladium & Platinum.

No, only the precious metals included in the Goldco Metals IRAs can be included or purchased through Goldco.

No. However, they can help clients to set these services up through the strategic partners that they recommend. They have a strong working relationship with each of these partners.

You have the choice to go with the ones you prefer.

- 403b

- 401k

- Roth 457b

- Roth 401k

- Roth IRA

- Traditional IRA

- Simple IRA

- SEP IRA

- Australian Saltwater Crocodile

- Maple Leaf

- American Eagle

- Lucky Dragon

- Gold Bars

- American Eagle Proof

- Royal Mint "Gold-Lunar Series-Coins"

- Buffalo

- American Eagle Proof

- Maple Leaf

- American Eagle

- Silver Bars

- Lucky Dragon

- Silver World War I

- Bald Eagle

- Silver World War II

- Royal Mint "Silver-Britannia Lunar-Series Coins"

While certain coins are allowed in Precious Metals IRAs, only some of these coins have been approved by the IRS, so that they can be included in IRAs. At the same time, not all bullion or bars are IRS-approved. The IRS has a list containing the precious metals that are acceptable for IRAs. Goldco deals with several precious metals within the IRS guidelines for IRAs.

Even though Goldco recommends Equity Institutional and Self-Directed IRA as the custodian options and Sterling Trust as a storage provider, you have the option to choose other storage companies or a custodian.

No. The IRS rules do not permit the storage of IRS precious metals in your home or storing the metals in a standardized safety-security box. These metals have to be held and stored in a bank or approved non-bank trustee within the IRS guidelines that will restrict access, as well as keep the precious metals isolated on behalf of the customer. This will ensure that the metals that the customer originally purchased are returned to the customer as soon as all the "legal distribution" requirements have been met. Similar to the traditional IRAs, access to your precious metals in a Precious Metals IRA have to be restricted to ensure that disbursement and deposit laws have been followed.

No. Similar to any other investment, the precious metal value cannot be guaranteed since it can fall and rise according to different market influences.

Once you reach the age of 59 and 6 months, your beneficiary or you can begin to take penalty-free distributions from your account (according to the IRS).

Yes. As part of their "Special Promotion", they provide customers with 5% to 10% back in FREE silver (5% on the $50K to $100K investments, and 10% on the investments that exceed $100K).

Yes. Goldco actually encourages their customers to sell the metal back to them since they have their own dedicated Buy Back Department and Program. Most customers state that the prices are competitive and reasonable.

None. An IRA rollover is a tax-free and easy process without penalties or any fees when adequately handled.

It typically takes up to two weeks, but Goldco does stress that every application will be different so the time frame will vary from one case to the next.

Goldco is a privately held company that specializes in protection of wealth and assets, rated A+ by the Better Business Bureau while it also has a Triple-A rating coming from Business Consumer Alliance and all the ratings are based on positive customer reviews of service, reliability and also ethical business practices.

Goldco has been providing quality brokerage services for precious metals IRAs that fall under the Internal Revenue Service rules. They are also involved in buying back the different physical precious metals or selling them through the precious metals market if a client starts distributions from their IRA.

15 Years in Business

What Makes Goldco Different?

We set out to discover what makes Goldco different from its competitors. This is what our research found:

- Goldco does an excellent job with handling all the paperwork as well as liaised with third parties on the clients behalf throughout the entire process.

- Goldco has many years of experience in the Gold IRA industry and have been able to maintain a top rating in comparison with their competition throughout this period.

- They have experts that specialize in different aspects of the business, rather than relying on a jack of all trades.

- They offer "white glove" service to all IRA clients. This services includes expert assistance at every level that is streamlined across the board to ensure that clients can expect the same expertise from their reps and strategic partners such as reputable and reliable custodians and depositories.

- The staff are trained to assess your unique and individual circumstances before recommending precious metal options to invest in your IRA. This is to ensure that each IRA portfolio is tailored to meet your individual needs including your available capital, financial goals and retirement needs.

- Goldco offers free and prompt delivery as well as storage for all cash purchases.

- Their pricing is competitive and they don't pressure you into buying.

- Special Offers For New IRA Clients:

- Get between 5% and 10% in free silver (5% for investments between $50k and $100k, 10% for investments of $100k and above with no maximum)

- All fees are waived for the 1st year when you invest more than 50k

What This Means For You!

When you open a new IRA account with Goldco and invest $50k, you would receive an additional $2,500 in silver and save $320 in fees for the first year. The more you invest, the more silver you will receive free of charge.

This is currently one of the most generous offers available in the industry!

In addition, Goldco has an entire department that is dedicated to our Buy-Back Promotion to ensure a streamlined process and competitive prices when clients decide to liquidate their metals.

They offer comprehensive educational resources including e-books, videos, blog posts and live price trackers which are fully backed by their customer support team.

Your retirement account will need to sustain you throughout your retirement years and decisions or changes made regarding your portfolio should never be made lightly. The years of experience and expertise that Goldco is able to provide to their clients relative to the precious metals industry and gold IRA's will help guide you in making the best investment decisions.

White-Glove Customer Service

Goldco highly prioritizes stellar customer service.

The company will always make sure they go above and beyond whether you need to open an IRA or outright purchasing precious metals.

Issues are resolved immediately. Sales are never pushed on you. So you definitely get the best bang for every buck with Goldco’s low-cost model.

Low Fees

The fee model with Goldco helps keep more money in your pocket – where it belongs.

You pay as low as $260 during the first year for precious metal IRAs, then each year after you pay $180.

Non-IRA transactions on the other hand attract $0 in fees. Yes, that’s correct. In addition to that, they will also store your previous metals free of charge (definitely impressive and not a perk most providers offer)

IRA & 401(k) Rollovers

The rollover process with Goldco will be quick and painless for you if you have an existing ira or 401K, or current ira retirement plan.

This is how the process looks like:

- You start by opening a new Goldco Precious Metals IRA

- A specialist at Goldco will help you on funding your account with your old IRA

- After the money transfer process, your Goldco specialist will help you in selecting precious metals that will best suit your goals and needs.

- Your Goldco IRA Specialist provides guidance to you through all steps of the entire rollover process, and that will typically take about 10 business days.

Buyback IRA Program

Want to sell your precious metals?

Goldco will certainly buy those precious metals back from you.

This is great news for most gold investors, as you are likely going to receive a higher price than you can expect from random gold coin dealers known for their low ball offers.

You will not be required to sell your precious metals back to Goldco, but that will save you a lot of headache while you can also expect a better deal than you would find elsewhere.

Comprehensive Educational Resources & Current Gold News

Goldco offers an extensive education center right on its website, with the aim of keeping investors informed about precious metals and IRAs.

Their in-depth blog covers a wide range of topics, and these include recessions, the debt bubble, trade wars, and more.

They offer several e-books that you can easily download. These include a 12-page gold IRA investment guide, The American IRA and 401(k) Crisis, 10 Reasons Why The Dollar Will Crash, and more.

If you don’t prefer videos, Goldco provides an extensive list that will dive into important topics including retirement threats, the dollar fluctuations, the stock market crashes, oil crisis, and more.

You can take advantage of viewing the live price trackers for the precious metals like gold, silver, platinum, and palladium directly from Goldco’s website.

Most importantly, Goldco’s customer support is always happy to help you by answering any of your questions or concerns.

Advanced Storage Options

For compliance with IRS regulations, you are required to store your IRA precious metals only at an approved third-party depository.

Goldco makes sure to only use the best of the available storage providers within the industry today and that helps in keeping all your precious metals safe. Such storage providers will use state of the art security and technology.

Which Providers Does Goldco Use For Precious Metal Storage?

Storage providers

Storage type

Annual storage cost

Delaware Depository (preferred)

Non-segregated

$100

Brinks Salt Lake City

Non-segregated

$100

IDS Texas

Segregated

$100

The Delaware Depository is what Goldco uses by default for the storage of your precious metals. It is a renowned depository that has an experience of over 200 years in precious metals, has state-of-the-art security systems, and Class 3 vaults.

But you also have the option of choosing another storage facility if you prefer to store your precious metals somewhere else.

How To Get Started With The Goldco Process

This is a sneak peek into the whole Goldco process— right from the contact phase initially to the finalization of the IRA rollover .

Step 1:

Calling the customer service rep kicks off the Goldco process for account setup.

Step 2:

After deciding on moving forward, the Goldco customer support representative will either transfer you to a Goldco IRA Specialist.

Or, you can instead set an appointment so that you can talk at a later time.

Step 3:

During the second phone call, the Goldco IRA Specialist will start gathering all the necessary information needed for the completion of your application, establishing your account, and transfer or move funds.

Step 4:

After getting your account funded, you can speak with a Goldco Account Executive who helps you on choosing the precious metals you need to have in your IRA.

That’s all!

As long as your gold or other precious metals are in stock, Goldco will transfer them to your depository of choice just within a few business days. When not in stock you can expect the metals to show up within 3 - 4 weeks.

Ready to get started with Goldco now? Click Here.

Goldco

Goldco is a leading provider of the precious metals IRA's. They pride themselves in excellent customer service as well the ability in helping individuals to properly diversify your porfolio retirement accounts.

Who Should Invest In An IRA With Goldco?

Goldco strives to offer services to a wide range of different types of investors including:

- Investments into physical or tangible assets that are going to last forever unlike gold ira rollover companies that could fold at a moments notice. Precious metals are the top choice for including tangible assets in an IRA portfolio.

- Investors who are looking for protection from volatile stock markets. Precious metals are considered to be a far safer and secure investment option and will ride out the tide when the stock market is in a slump.

- Investors who are nearing retirement and don't want to risk another financial crisis draining their IRA. Precious metals offer stability in times of economic crisis and increased inflation to protect your investment and ensure that you are able to live out your retirement in comfort.

Should You Invest In A Gold IRA With Goldco?

If you are considering investing in precious metal as part of your IRA portfolio or as a direct purchase, Goldco offers competitive prices and streamlined processes to meet your needs.

Their business is laser targeted on our customers and their investments. The proof lies in their simplified account setup process, low fees and comprehensive educational resources that will WOW every customer.

Plus, you get direct access to a specialist who will take care of the transfer/rollover process with no hassle or fuss. Direct investors will have their own account executive to ensure a smooth process and that you receive your metals efficiently.

0 comments