Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

There are many ways to store your IRA gold. Some people use a home storage unit. But if you prefer to store your gold somewhere safe, it's best to use a third-party custodian. Your broker can provide you with a list of custodians who will store your gold for you. Most custodians charge a small annual fee. However, you must keep your gold in the custodial account until you reach retirement age.

What is a home storage gold IRA?

There are several factors to consider when investing in gold, including how much to store, where to store it, and whether to keep it at home or in a bank safe deposit box. The decision about where to store your gold is vital since gold is a volatile investment. You can store it in a home safe, a bank safe deposit box, or a professional storage facility. Another option is to purchase gold and store it at a gold dealer.

Home storage gold IRAs are becoming increasingly popular for retirement investors looking for a safer way to store their wealth. With the economic instability, people are searching for more secure ways to own their wealth, and home storage gold IRAs have emerged to cater to these needs. This type of retirement saving account allows customers to take delivery of their gold, while retaining control of their IRA. Home storage gold IRAs are designed to help you save for retirement by letting you manage the account yourself.

Can you store IRA gold at home?

It is not permissible to store IRA gold at home. It is not even legal to invest in gold bullion and store it at home. Your gold must be stored in an approved depository and be kept under strict control of an IRA custodian. Although many advertisements claim that you can store IRA gold at home, this is not true. It would be illegal and could lead to high IRS penalties. You should always work with an IRA custodian and get all your paperwork in order before you try this.

If you decide to store your gold at home, you will need to know the rules about IRAs. Gold IRAs are considered a distribution, and you will face a 10% tax penalty if you are under age 59.5. Additionally, the gold will be taxable, so you will have to pay taxes on it immediately. In addition, you may be subject to an IRA audit, which can cost you additional fines.

Where is the safest place to store precious metals?

There are several options for storing precious metals in an IRA. The traditional method is to use safety deposit boxes. These are usually very cheap to maintain, ranging from $50 to $200 per year. The problem with this method is that you don't have access to your precious metals once they are locked away. This can be problematic if you want to trade your gold down the road. Private storage facilities should have a clear policy defining how much access they will allow you to have.

If you'd prefer to keep your precious metals out of sight, you can install a safe in a secure location at home. The safe should be hidden away and out of the reach of children. Alternatively, you could store your precious metals in a depository, also known as a vault. Depository storage facilities have temperature-controlled cabinets and are professional. You can also purchase insurance to protect your precious metals, though it's unlikely to be as convenient as storing them in a vault.

What is a precious metal depository?

A precious metal depository is a secure storage facility where precious metals are stored. The federal government stores its gold at Fort Knox, while the New York Federal Reserve Bank stores precious metal for governments around the world. These facilities are physically secure and feature on-site protective personnel. Most are also generously insured. The gold doesn't leave the depository until a customer requests it. If an investor wants to store their gold at home, they should use a depository that provides this level of security.

A depository will offer state-of-the-art security and insurance to safeguard their investors' investments. They also keep their precious metals out of reach of bad actors. In addition to providing superior security, a precious metal depository also provides the peace of mind that comes with knowing your money is safe. A depository is an ideal solution for investors who want to hold their precious metals for long-term storage. These facilities are safe and secure, and they charge storage fees.

What is a gold IRA custodian?

Gold IRAs are special types of individual retirement accounts (IRAs) that let you invest in physical gold. These accounts are generally set up with pretax dollars, though you can also invest in post-tax money. If you're planning to invest in gold, you need a gold IRA custodian, who will take care of your investment. Since you'll need to buy physical gold, there are higher fees associated with owning this type of account.

IRA custodians are required by law to store your gold at an approved bank, national depository, or third-party trustee. While you can transfer your gold from your current retirement account to a gold IRA, you need to deal with paperwork and tax reporting. You can also get help with the storage of your gold bullion by using a self-directed Gold IRA as provided by some of the best companies for iras. This is a great option for those who want to transfer money from a traditional IRA to a gold IRA. A gold IRA custodian can also help you transfer an existing retirement account.

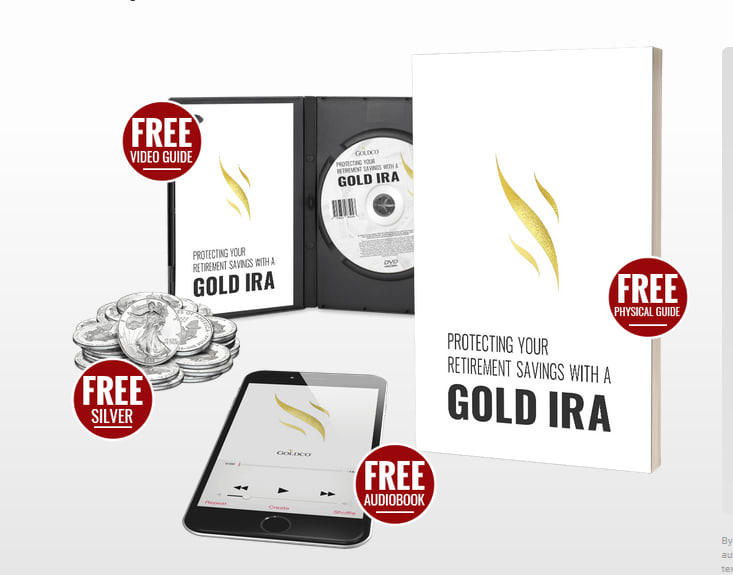

Goldco

Goldco is a leading provider of the precious metals IRA's. They pride themselves in excellent customer service as well the ability in helping individuals to properly diversify your porfolio retirement accounts.

0 comments