Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

When it comes to your retirement's nest egg, there is no question that it is a hard decision when trying to find the best gold IRA company that can assist your in rolling over some or all of the funds in your 401k or IRA, into gold and or silver. Inside this self directed gold IRA comparison article we have done a lot of the research for you and below you will find what we think are the top self directed gold IRA investment companies, whether you are an investor or retiree.

Gold Investment Company Reviews & Comparison

#1 Goldco

- Best overall precious metals company

- Exceptional customer Experience

- Low fees

- Outstanding client reviews

#2 Birch Gold Group

- A+ BBB rating

- 7,000+ customers

- 15+ years in business

- Great customer reviews

#3 Augusta Precious Metals

- Award winning IRA investment company

- Transparency

- High level of customer service

- Outstanding customer reviews

#4 Regal Assets

- Exceptional reputation

- Flat IRA fees

- Great customer service

- Great customer reviews

#5 Noble Gold

- Best in customer satisfaction & education

- Low annual fees

- Low minimum investment

- Outstanding customer reviews

#6 Advantage Gold

- Excellent customer service & education

- Low annual fees

- U.S. Mint Dealer

- Outstanding customer reviews

Top Gold Investment Companies Reviewed

#1 Goldco Precious Metals

Goldco Precious Metals offers individual Gold Retirement Accounts that are self-directed, which can be used to directly buy gold or as an investment tool.

Founded in 2006, Goldco has a long track history when compared to their competition.

If you decide to sign up with them, Goldco will assign you to an IRA account executive, who will hold your hand through the process of getting started and will make sure your IRA account is set up to meet your investment goals.

They have an A+ rating with the Better Business Bureau and INC. 5000 has ranked them as one of the fastest growing privately-held companies in the United States.

Pros

Cons

#2 Birch Gold Group Precious Metals

Birch Gold started operations in 2003 and has maintained a stellar reputation since then. Their celebrity clientele list includes Ben Shapiro. Based in Burbank, California, Birch has high rankings with sites like Consumer Affairs, Google Business and the BBB.

Birch Gold Group has a transparent and ethical business process, empathetic customer service and also offers educational resources to help their clients to meet all their goals and objectives when it comes to investing in gold.

You can speak with a gold Roth IRA specialist who will explain the latest trends and news with the stock market and how it can impact gold prices and also your IRA. This thorough process will not only empower you to make an educated decision about your retirement objectives, but it will also help you to better understand the risks and growth potential.

Pros

Cons

#3 Augusta Precious Metals

Augusta Precious Metals has a team of professionals that essentially are your "partners" when it comes to gold IRA investing. They will help to educate you on different market conditions, while helping you protect your retirement savings. Augusta provides education focused IRA investment opportunities to its clientele, since 2012.

Augusta's goal is to empower their clientele, which can be clearly seen from the ratings and reviews on the BBB, National Ethics Association, Facebook and Google My Business, not to mention one of their celebrity clients, Joe Montana.

They are able to offer a high level of customer experience, by having 4 different departments, which include an economic analytics team that assists with understanding the markets, a customer success agent, a processing team that takes care of all the legal work, and the order desk which helps you with choosing the right precious metals.

95% of the paperwork is done by their staff, including gold IRA rollover and transfer forms.

Pros

Cons

#4 Regal Assets

Regal Assets has received praises from Huffington Post, Bloomberg, Forbes and Inc 500. Not to mention celebrity endorsements from Laura Ingraham and Dennis Miller. They have an almost 10 year history and claim to have one of the "highest rating profiles" in the gold Roth IRA industry.

The company helps with the transfer of not just 401k or IRA accounts, but also TSP, SEP and 403(b) plans. Something unique about Regal Assets is that they have additional product offerings not available from other gold IRA investing companies.

They offer worldwide segregated (no shared ownership) metal storage at a low cost, your assets are fully insured, and you also have the option for getting gold bullion delivered directly to your home, anywhere in the world, because of their relationships with affiliated vaults, that are located in numerous cities worldwide.

Most gold Roth IRA firms, charge fees based on a percentage of your investment, but with Regal you can get a low flat rate for the life of your account. These are just a few of the things why Regal is recognized as one of the best gold investment firms in the world. Not to mention they offer full-time surveillance and guarded vault protection.

Pros

Cons

#5 Noble Gold Investments

Noble Gold Investments is based in Pasadena, California and provides an easy and safe way to invest in gold. The company can help you to protect your retirement by offering a gold IRA account and also with buying and storing of gold bullion in their Texas based IRA Gold depository.

The International Depository Services is the name of the vault that physically stores your ira gold coins or bars.

They offer multiple options for receiving their gold survival pack, which can be picked up in person, forwarded or delivered to you. Noble Gold has a solid reputation, which includes great consumer ratings from Business Consumer Alliance, Consumer Affairs and the Better Business Bureau.

Noble Gold Investments offers a free kit that can educate you more on how gold IRA's and gold investments work.

Pros

Cons

#6 Advantage Gold

Advantage Gold is one of the top retirement investment industry leaders, when it comes to precious metal and gold IRA rollovers, they have won the Best of TrustLink award 5 years in a row, making it hard to deny them as one of the best gold based ira companies.

Based in Los Angeles, California, they are gold ira experts at converting 401K or IRA accounts into gold and are known for educating their new clients and investors during every step of the way.

Advantage Gold's customer service is ranked as one of the top, they have very generous buyback policies in the event you want to liquidate, prompt customer assistance, and not to mention the thousands of positive customer reviews.

They have top ratings from the Better Business Bureau, TrustLink and TrustPilot.

Pros

Cons

What Is A Gold IRA Account?

Gold IRA's are retirement funds or accounts that are self-directed and invest in gold or other approved precious metals as opposed to paper assets. Other than the fact that the IRA is backed by real, physical gold, there is very little difference between traditional, Roth IRA accounts and a Gold backed IRA.

However, just because the account holds physical gold does not mean that you take possession of the gold. The gold is stored in a secure depository. You do have the option to buy gold from a dealer and keep this yourself.

It is important to weigh the risk as well as the rewards of gold investment before opting for a gold backed IRA. For example, gold has historically had the ability to beat inflation and hold its value. On the other hand, when stocks are doing well, gold tends to lose some value.

What Do Gold IRA's Cost And How Do They Work?

Gold IRA's work in very much the same way as traditional retirement accounts with the exception that they hold gold or other precious metals such as silver, platinum or palladium. Commonly, an initial investment of $10,000 or more is required to start a gold backed IRA. However, it is possible for those who do not have this amount to buy gold that will be held in secured depository that is managed by an IRA gold company.

Once you have deposited funds into your gold backed IRA account, a broker will buy gold or precious metals according to your direction. A gold IRA custodian or trustee (like a bank, credit union, trust company, loan provider or other types of federally or state approved organizations) will manage the account. Gold can also be held in EFT's or mutual funds with the approval of the IRS.

Step 1 - Invest funds into the gold IRA account. You can either transfer funds directly into the account or you can rollover funds from an existing IRA account (such as a 401k, 403b and 457b). Depending on your age, you are allowed to transfer up to $7,000 annually. In most cases, the IRA company will set a minimum investment amount ranging anywhere from $100 and $15,000. However, this minimum is commonly between $2,000 and $5,000. Remember to check the minimum for the IRA company that you have chosen to use. You can also use pre-tax and post-tax dollars to purchase precious metals.

In 2020, the limit for annual contributions was set at $6,000 by the IRS. For those who are over the age of 50 years, the limit is $7,000. If you have an existing IRA and choose to rollover the funds for the purchase of gold bullion or coins, the amount is not subject to tax and there are no fees. The IRS is the regulatory body for rollover limits into gold bullion IRA's.

Step - 2 You will need to pay commission and fees to the brokerage firm or dealer you are using. Commission normally ranges between 2% and 5% of the gold spot price. You can also expect to pay a fee of between $30 and $50 per transaction. In addition, you may be charged the following fees:

- An admin or processing fee of between $50 and $100 to set up the gold IRA account.

- A storage fee that is charged by the secure depository where the gold is held and passed on to you by your IRA administrator. You can expect to pay between $100 and $300 for storage and insurance every year.

- A maintenance fee of between $50 and $300 per year. In some cases, the maintenance fee will be waived for the first year.

- Miscellaneous fees that may include any costs associated with running the gold IRA account such as wire transfer fees. Make sure that your self directed gold IRA company discloses all additional fees that you will be responsible for.

Step 3 - Withdraw funds form the IRA account at a suitable time. You will need to contact the gold ira custodian or trustee of the account and complete the required forms to withdraw funds from the IRA. Before withdrawing, it is advisable to ensure that it is a good time to sell gold. If it isn't, rather withdraw from other IRA accounts.

When your reach the age of 72 years (or 70 and 1/2 years if your birthday is before 1 January 2020) you become subject to minimum distributions. This means that you are required to withdraw a certain amount from the IRA account every year. If you withdraw funds from the IRA before the age of 59 and 1/2 years of age, you will be subject to penalty taxes should the account be younger than 5 years.

Gold Performance Over The Years

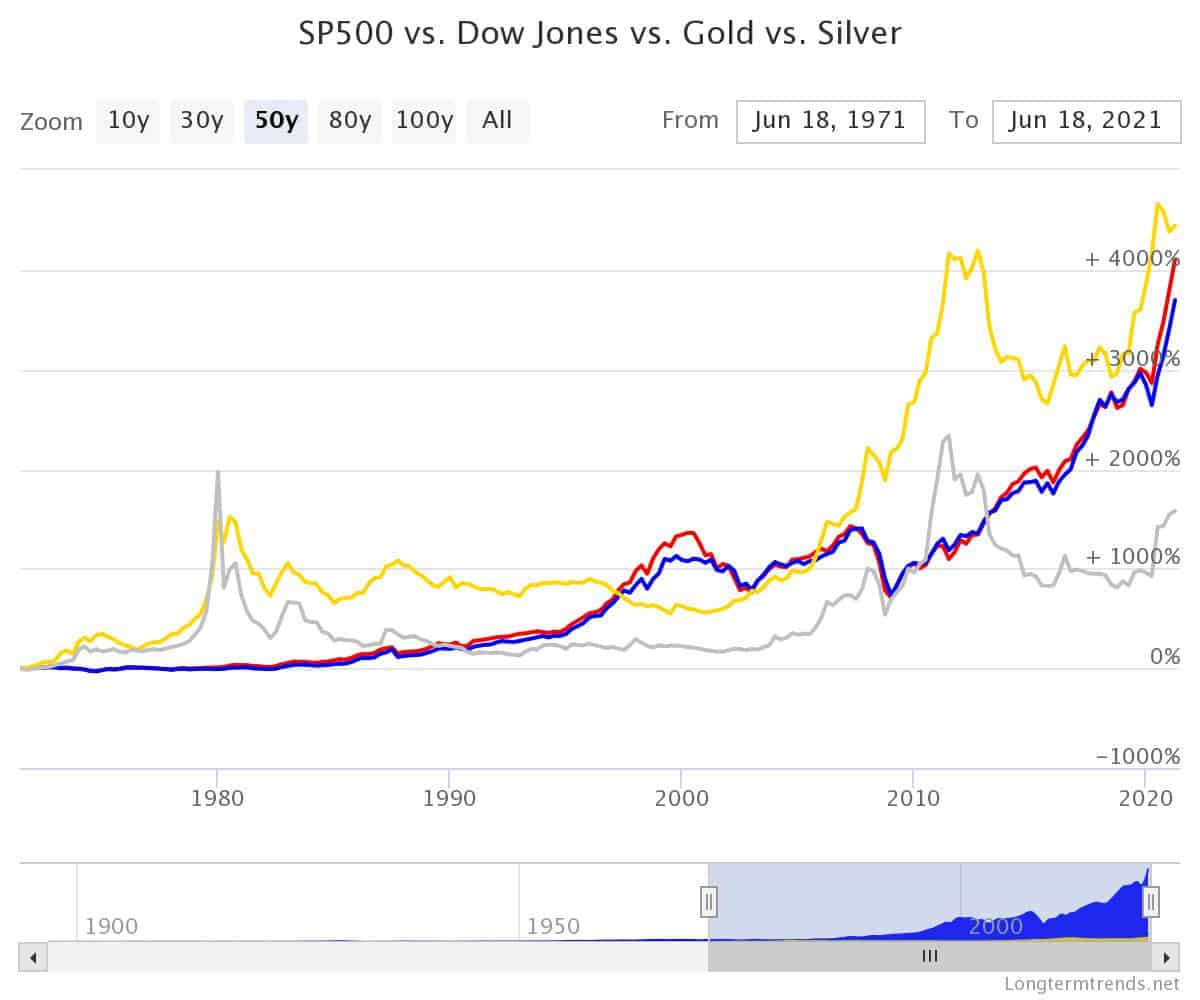

Over the last two decades, the gold price has increased overall although there have been some downs. The value of gold was $1,764 an ounce as of June 19, 2021.

Historically, the stock market has experienced greater returns than silver and gold. However, from the year 2000 to 2020, gold and silver have outshone both the Dow Jones and the S&P 500.

Always keep in mind that historical performance may not indicate future performance and a decision to invest in a gold bullion IRA should therefore not be based purely on past data.

The Pros And Cons Of A Gold IRA

A self directed gold IRA carries similar risks to that of any other type of retirement account. However, one of the greatest benefits of a gold bullion IRA is that it allows for a diversified retirement portfolio. Advocates for gold propose the reliability of gold over the inconsistency if value of paper currency.

The value of precious metals on a specific day is dependent on a large number of different economic factors including demand, supply, the health of the market and the value of the dollar. During times of extended inflation and economic uncertainty, gold has traditionally increased in value.

A disadvantage is the number of higher fees and charges to store gold in comparison with traditional or Roth IRA's. In addition, gold and silver don't pay out dividends and won't produce income stock. Rules also apply to collectible coins and you are not allowed to keep gold in your home.

Pros Of A Gold IRA Account

- Offers protection against inflation and economic downturn

- Provides diversification of a retirement portfolio

- Grants greater control over assets for the investors than typical retirement accounts

- Provides tax incentives

- There are options available to invest in different types of gold such as bullion, coins, and other precious metals

- Gold is a liquid asset

Cons Of A Gold IRA Account

- Doesn't pay interest or dividends

- Costly custodian fees

- Self-storage is prohibited

- The choice of trustee is severely limited by strict IRS custody guidelines

- There are no bank guarantees

- There is a minimum deposit requirement

- Tax penalties apply for early withdrawal or distribution

Reasons To Open A Gold Silver IRA Account

- It provides the opportunity for diversification. Investing in a single asset carries greater risk. A gold and silver IRA is a good option where an existing IRA portfolio doesn't include precious metals.

- A safety net against inflation. When the U.S. dollar loses value, your purchasing power decreases. Traditionally, gold has outpaced the dollar protecting you from this type of loss.

- When the economy is in a slump, the stock market takes a turn for the worse. Gold on the other hand has historically held its value or increased in times of economic difficulty. It offers a secure IRA investment option especially for those who are closer to retirement age and want to reduce the risk of losses.

- Gold has increased steadily over the past few decades to reach its all-time high in 2020. It is therefore a secure investment for growth.

In general, gold is considered to be one of the safest investments because it can withstand severe economic downturns and market fluctuations.

Gold Investment Tips

If you are considering gold investment as part of your retirement portfolio, the tips below can assist you in negotiating the territory of Gold and Silver IRA's:

Reputable IRA Gold Companies

You need to find a gold IRA firm who is honest and transparent in their dealings.

- Stay away from companies that offer coins that are not IRS approved or discounts on home storage.

- Do your due diligence and go online to read gold IRA reviews and comments for specific IRA gold companies from existing or prior clients.

- Choose a company that has been in existence for a number of years and has a good reputation in the industry.

- Be aware of scams. A pushy sales pitch or offering rare and collectible gold coins that are not IRS approved are normally signs of a scam. Other scams will involve "fake" IRA accounts, transferring funds into an unknown account, feigned gold purchases and using funds to operate their own business. Falling for a scam can result in significant losses.

- Ask questions and expect informative and transparent answers.

- Read any paperwork carefully and ensure that all the details are included. Stay away from contracts that are murky or unclear.

To ensure that your funds are secure, only do business with legitimate and credible IRA gold companies that you can trust.

Reputation in the gold market is equally as important. Review third party ratings and consumer gold ira reviews to find the ones that add up to a good overall experience.

Review sites like Trust Link, Business Consumer Alliance and the Better Business Bureau are all great reference points. But also follow your own intuition.

Choosing The Best IRA Fee Structure

There are two types of fee structures that are generally offered by gold IRA companies - flat and scaled. A flat annual fee means that you will pay the same fees every year regardless of the size of your investment. Scaled fees on the other hand will mean that you pay more as your investment grows.

If you are looking to grow your investment, it is always recommended to opt for a flat annual fee rather than a scaled fee. Medium to large investors (a C.F. of over $50,000) can end up paying thousands of dollars in fees every year for their account. Seeing that the entire goal of an IRA is to grow your initial investment, it is always advisable to only choose IRA companies that offer flat annual fees and avoid scaled fees at all costs.

Additional IRA Gold Account Investment Tips

- Find a trusted financial advisor who is experienced in gold investment and familiar with your existing IRA portfolio. They will assist you in diversifying your portfolio and ensuring that you reach your financial goals by retirement age. It is also recommended to choose a smaller IRA gold company to start with to become more familiar with gold investment before exploring investing in other precious metal options.

- Avoid pushy sales tactics and poor customer support. Agents that try to push into buying numismatic or collectible gold coins are doing so only because the sale will mean greater profits for them. Collectibles are not the recommended route for investors and are not approved for IRA's by the IRS. Ask as many questions as possible when approaching a gold investment company and test their knowledge of the industry. If your questions aren't being answered in detail and transparently, move on. Remember that the only silver and gold bullion stored by approved custodians qualify to be included in an IRA by the IRS.

- Efficient and quick delivery times are critical in today's ever-changing economic landscape. There are instances of IRA gold companies taking as long as 60 days to set up an account. This is unacceptable because every day that it takes to set up the account, your funds are not gaining value. Ideally, a company should set up your account on the same day or within 24 hours. You should then be able to fund the account within 3 to 5 days and immediately be able to start buying or selling bullion.

- Take into account the type of secure depository. IRS regulations stipulate that precious metals may be stored in either allocated or unallocated depositories. Allocated depositories are like safety deposit boxes. Each individual's "box" contains only the gold or other precious metals that they have purchased - untouched by other investors' assets. Unallocated depositories are vaults or secure warehouses where the gold is stored together according to weight year, refinery, and size. Upon distribution, an investor will receive a gold bar, coin or other type of bullion that is similar to what they purchased but may not be the exact same item. In most cases, the IRA company should provide you with the option to choose allocated or unallocated storage either offshore or domestic.

Buy high caliber assets

Gold is considered to be a tangible commodity, which distinguishes it from traditional assets, such as stocks and bonds. How worthy gold is as an investment depends on its condition and quality. There are sadly disreputable brokers who buy damaged metals only to resell them falsely as pristine stock. As such, you always have to verify the quality of gold before you buy it. Precious metals get valued by weight, which means damaged or scratched coins and bars aren't as valuable as they would otherwise be in like-new condition. Only accept stock if the weight matches manufacturer specifications. Precious metals that you can include in an IRA include silver, gold, palladium, and platinum.

Gold: Coins and bullion are easily the most popular kinds of investment in terms of precious metals. Per the Internal Revenue Code, in order to be eligible, gold must have a minimum of .995 fineness to it.

Silver: The second-most popular kind of precious metal in IRA accounts must also have a minimum level of fineness. However, unlike gold, it must be .999.

Platinum: The minimum purity level for platinum is .9995 if it's going to be eligible for IRA storage. This precious metal can be stored in either bar or coin form and can also use the same storage as other precious metals, including silver and gold.

Palladium: Palladium's discovery happened in 1803. It was named for Pallas, which is an asteroid whose name traces back to Athena, a Greek goddess. The minimum fineness level is .9995. Palladium looks like platinum physically. From 2016 to 2019, its value tripled.

Should You Get Gold Coins Or Bullion?

When buying physical gold for a gold coin IRA, an investor is free to decide between sovereign ira gold coins and bullion. Both of these are pretty much valued in similar ways, which is per ounce contingent upon gold's spot price. Having said that, sovereign ira gold coins might be a safer decision. Generally speaking, you might want to look at sovereign ira gold coins that are well-known. These include the Canadian Maple Leaf and the American Eagle. These are very recognizable and simpler to trade. They also usually sell for higher premiums, as compared to bullion bars. If you have the smaller 1-oz. bullion bars, they're harder to actually sell back. Their markups are also higher. Larger bullion bars work better for institutional investors.

American Gold Buffalo Coin

American Gold Eagle Coin

Australian Gold Kangaroo Coin

Australian Lunar Series Coin

Austrian Gold Philharmonic Coin

British Britannia Coin

Canadian Gold Maple Leaf Coin

Credit Suisse Gold Bar

Gold Chinese Panda Coin

Johnson Matthey Gold Bar

Valcambi Gold CombiBar

On the other hand, if you decide to use a reputable physical gold IRA company that emphasizes customer service, then they're probably going to have buy-back policies with favorable terms for both bullion and coins, even though they might have higher transaction costs for bullion.

Keep current with spot prices

As with other commodities, the market determines the price of most precious metals. Gold prices go through fluctuations that are known to happen with other markets. Even though gold prices tend to more consistent than other assets, there are still up and downswings. There are regular fluctuations in the market values for precious metals, including gold and silver, so posted sales prices have to be frequently updated and corrected.

Whenever you can, it's usually a smart move to buy bars instead of coins. Typically speaking, gold dealers enjoy higher commissions when they sell coins, and yet bullion bars more accurately reflect spot prices.

Always ask for detailed receipts

Vault receipts might also be called warehouse receipts or warrant receipts. Whatever you call them, they are proof of ownership of precious metal commodities. They're an industry standard to confirm transfers. Detailed receipts are crucial to either prove or disprove a precious metal's true value if it's bought or sold, particularly in terms of the time and date of purchases.

6 IRS Approved Depository Vaults

- Scotia Mocatta

- JP Morgan Chase Bank North America

- HSBC Bank USA

- Delaware Depository

- CNT Depository

- Brinks Security

Follow every IRS rule and regulation about gold based IRAs

Collectible and rare gold coins provide distinct investment opportunities, although you have to verify their legitimacy and worth. As already mentioned, the IRS has rolled out particular requirements for the kinds of gold bullion that can be eligible for a gold based IRA. If you want to learn more, then you need to read more about the rules the IRS has for investment regulations and IRAs in particular.

Can A Physical Gold IRA Be The Best Path To Gold Investment?

You can invest in gold in quite a few ways, but a gold based IRA is just one of them. However, is it the most effective way? It really depends on a handful of different things. Investors are certainly free to buy gold coins and bullion outside the confines of an IRA. The IRS places no restrictions on what you can own or how you have to store your gold. Investors sometimes store gold in their homes so they can avoid storage and custodial fees. Investors that retain their gold for over a year can take advantage of favorable tax rates through capital gains instead of normal income tax rates, ones that you'd pay if you sold gold before withdrawing funds from your IRA.

Physical gold won't generate income, and that's usually important to anyone in retirement. In order to generate income, gold must be liquidated in order for funds to be withdrawn. Retirees getting to the age of 72 need enough liquidity in their overall requirement account to actually take required minimum distributions or RMD. This can sometimes force them to sell a portion of their holdings in gold.

This can be a problem for any retirees who invested heavily specifically in gold. It might be less of an issue, and even more preferable, if they just had a physical gold IRA as a component of their larger retirement portfolio. Owning gold inside the IRA structure can be a sensible move when it's part of a broader diversification strategy since gold is often a useful hedge against inflation. Investors are able to have multiple IRA accounts. When IRAs have paper assets, the owners can enjoy multiple sources of RMD withdrawals and current income.

Traditional IRAs might prove to be better choices for younger investors that have less money to put into gold. Gold equivalents can be great choices, whether they're gold mining stocks or gold ETFs, at least until they save up enough to feasibly meet the bigger minimum requirements that prove a hurdle to joining a 401k gold IRAs. Exchange Traded Funds investement strategies include the following:

In order to really make the most of any physical gold IRA, it's best to make an accumulation vehicle that's just one factor in a wider and truly diversified investment strategy. However, you can still accomplish this even without a physical gold IRA.

Why do gold IRAs prove so popular?

Gold IRAs have become more alluring to investors over the last t10 years given the broader levels of control that come with physical assets when compared to paper investments. Gold's value happens independently from the stock market, a market known for unexpected crashes and unpredictable fluctuations. Gold Coin IRAs have seen an increase in demand ever since 2007 to 2009 and the Great Recession as more firms are now offering precious metals such as gold as investment possibilities. Financial advisors frequently recommend investors put some of their assets into either a 401k gold IRA retirement plan or broader self directed precious metals IRA so they can diversify their retirement portfolio enough to complement mutual funds and stocks, instead of placing everything about their retirement savings into a single source or pot. Since gold value often moves in a contrary direction to paper asset values, you can use a gold coin IRA as a hedge against stock market downturns and inflation.

Frequently Asked Questions

A gold IRA is a individual retirement account that is self directed, which invests or holds precious metals, such as physical gold.

A gold IRA which is also known as a Precious Metals IRA ,are Individual Retirement Accounts, that has approved precious metals, such as physical gold held in custody to benefit the owner of the IRA. It works exactly the same as a regular IRA, but instead of investing in paper assets such as stocks and mutual funds, it invest in physical bullion bars or coins.

Gold is always going to be a physical asset. Given this, theft is always going to be a possibility. Even if you put your gold into an insured depository, there's still a chance it might get taken via fraud or burglary. Be sure any company you use stores its gold only in legitimate depositories. Brinks and Delaware Depository are two good choices. Do your homework and ensure that any depository holding your precious metals has standards that you can live with. You should have the peace of mind that your gold is stored securely.

Some investors find that supplementing their portfolios with modest volumes of gold is an effective investment tactic. It's a good way to achieve some diversification, although putting all of your retirement nest egg into gold isn't smart. Gold investments aren't going to pay dividends the way that many stocks do, and yet, they're a good way to hedge your investments against potential inflation. Typically, the prices of gold will move in directions opposite where conventional paper investments head.

Some even see gold as a fundamentally simple investment in a larger world full of seriously complex money moves. If you look over the last several decades, you'll gold prices going up and down, but they tend to go up overall, particularly when a recession is happening. The financial crisis of 2008 was a great example of this, as the market began favoring gold at a time when many other investment returns started dropping. Consult a financial advisor to help you decipher the movement of gold prices on any given day.

To convert your traditional IRA to physical gold, you need to do what is referred to as a roller, where you transfer the funds from your existing IRA into a self directed IRA. The IRS will allow for one roll over of IRA funds every 12 months.

Gold IRA rollovers let investors move retirement savings into an IRA backed by gold. Certain brokers facilitate these rollovers so they can do the work for you while keeping initial investments free of taxes. If you're unsure of the rules, ask your broker, but most of them offer no-fee rollovers. You can roll funds over into these kinds of retirement accounts:

- Roth IRA

- Simple or SEP IRA

- Traditional IRA

- 401(k) and 403(b)

- Pension plans

- Annuity plans

- TSP (Thrift Savings Plans)

You're not able to take physical possession of the gold inside your IRA. It has to be stored inside a bank or facility that the IRS approves of. You might be subject to too seriously high penalties should you store your IRA gold inside your home. Once your IRA term is over, you are able to liquidate your various gold assets for cash without penalty. You can also just assume possession of the gold at this time also free of penalty.

You have the freedom to convert IRA funds through withdrawing them. Be sure you're familiar with the IRA terms prior to withdrawing funds, however. Certain accounts will be subject to taxes and penalties for any early withdrawals.

Yes. You can maintain a traditional IRA while also having a precious metal or gold IRA at the same time.

Sadly, the answer to this one is no. Even if you have precious metals, including gold, that meet the IRS purity standards, their regulations prohibit you from adding gold that you already possess into your gold IRA. As with other various IRA accounts, a gold IRA account must have a custodian that manages the accounts. That includes any gold handling.

Precious metals, especially gold, that are in your designated gold IRA have to meet the IRS guidelines. You're still free to buy collectibles by yourself and keep them, but they won't be a part of your gold IRA.

Only high purity gold bullion products are IRS approved such as the American Buffalo, American Eagle, and the Canadian Maple Leaf.

Gold has to meet the IRS-specific standards if you want it to be eligible for gold IRA account use. Gold products that are eligible meet 99.5-percent purity fineness requirements at a minimum. They must also be considered not highly collectible, in addition to coming from an approved foreign mint or a U.S. Mint. The Federal Trade Commission says that bullion metals get crafted into pure coins or bars:

Gold Bars: Gold that is IRA-eligible is available in 24-karat pure bars weighing from 1 to 400 ounces. They must have hallmarks from qualified assayers or refineries.

Gold Coins: There are gold bullion coins minted purely for investment purposes. You should know that proof coins, including rare coins, are meant for collecting rather than investing.

Gold IRA Companies or Custodians are investment firms that specialize in the set up of Gold Individual Retirement Accounts from start to finish, which includes, not just account setup, but also IRA transfer or rollover, purchasing qualified precious metals, and storing your precious metals with an accredited depository.

Yes, you can buy gold bullion and coins, as well as other precious metals for your IRA, but it must be a self-directed IRA established with a trust company.

Each gold IRA company have different fees and minimum investment requirements, but there are gold IRA companies that allow you to open a gold IRA account with as little as $100, plus any administrative costs and applicable storage fees.

Most financial experts recommend gold to be 5 to 10 percent of your portfolio. But it depends on your risk tolerance and individual situation, as you may be more comfortable with a smaller or bigger share of gold in your investment portfolio.

By investing in gold or other precious metals, you are taking the first step to protect your retirement savings with a tangible asset such as physical gold instead of the devaluing dollar. The good news is that you can easily rollover your existing IRA or 401(k) into a gold IRA. There are no penalties to do the transfer and it's also a non-taxable event.

You would do what is referred to as a Direct Rollover: Which moves your funds from one retirement account to another. This 401k rollover or transfer, can be easily done by a gold IRA company, without the 401k's owner touching the money.

Best Gold IRA Company (#1 Rated)

After doing indepth research on all the major 401k gold IRA investment companies and the gold ira custodians, Goldco checks off all of boxes when it comes to customer gold ira reviews, ratings, storage options, management fees and trustworthiness.

Bottom Line: Gold IRA's are one of the best ways to protect your retirement and you have several options when it comes to choosing Gold IRA companies.

While gold coin IRA's can be a smart investment, these type of investments are not for everybody.

However, if you're concerned with losing your retirement in the stock market, a gold IRA account could prove to be a wise, long term investment to hedge against inflation and stock market fluctuations.

If you thinking about adding gold to your retirement investment strategy, consult with your financial advisor, in addition to doing your own research, to determine if a gold IRA retirement plan will meet the goals of your financial plan.

Gold can have some great advantages for the right investment portfolio.

Gold IRA Comparison Chart

BEST CHOICE

Overall Rating

5.0/5

BEST EDUCATION

BEST CUSTOMER

Overall Rating

4.8/5

0 comments