Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

Can I use my IRA to buy crypto?

Can you invest in crypto through a Roth IRA? How do I hold my crypto in my Roth IRA? Investing in cryptocurrency is a growing trend. Increasingly, it is a popular form of investment, as it is highly secure due to its blockchain technology. In addition, it is considered a hedge against inflation, as it is a "off-the-grid" investment. This means that governments cannot manipulate it like other currencies.

Investing In Cryptocurrency With Self-Directed IRA

Investing in cryptocurrency through your Self-Directed IRA is a great way to take advantage of tax benefits and gain more control over your retirement money. There are two types of self-directed IRAs: traditional and Roth. Traditional self-directed IRA contributions are tax deductible, and qualified Roth self-directed IRA withdrawals are tax-free. You can invest in cryptocurrency through your Self-Directed account if you have funds that are not used for other purposes.

Investing in cryptocurrency through a self-directed IRA is a great way to diversify your portfolio and save tax. Many companies specialize in self-directed cryptocurrency IRAs. They offer trading platforms that make it easy to invest in many cryptocurrencies. These companies also provide account custody and service for clients.

Before investing in cryptocurrency through your Self-Directed IRA, you should make sure to do your homework. While digital currencies are lucrative, they are volatile and are not regulated. Therefore, it's important to consult with a reputable self-directed IRA administrator. He or she can assist you in opening your account and answer your questions about investing in alternative assets.

How Do I Buy A Crypto In A Self-Directed Roth IRA?

When you decide to buy cryptocurrency for your retirement account, you need to understand the risks and the regulations. Every transaction creates a taxable event, and any gain or loss on those transactions must be reported on your tax return. As with any investment, you should keep records of all your transactions to avoid IRS audits. You should also use a custodian, not yourself, for your cryptocurrency investments.

Investing in cryptocurrency through your IRA can be an exciting way to invest in these illiquid assets, but it can be complicated. You will have to take on many administrative responsibilities, and it can be difficult to decide where to invest. Fortunately, there are a number of trustworthy providers who will help you with the technical aspects. One such provider is Nabers Group, a crypto IRA provider that is IRS-approved and offers a platform for self-directed crypto investing. Unlike other exchanges, Nabers Group's customers hold their own keys. This allows them to choose which types of coins they want to buy, and how much to invest in each. This also ensures that investors are not compromising their privacy or security by handing over their private keys.

Investing in cryptocurrency requires a self-directed IRA, and it involves establishing a digital wallet. A cryptocurrency self-directed IRA involves setting up a digital wallet and a checkbook control LLC. Once these steps are complete, you can then purchase crypto from any platform that supports it. The cryptocurrency self-directed IRA is a self-directed IRA account that uses the funds in your IRA to invest in crypto.

Can You Buy Bitcoin In A Self-Directed IRA?

Can you buy Bitcoin in an IRA account? Can Bitcoin be held in an IRA? Can I hold Bitcoin in a self-directed IRA?

You may be wondering whether you can buy Bitcoin in your IRA. After all, it's a form of cryptocurrency that uses blockchain technology. These digital coins can be exchanged for goods, services, and even dollars. However, there are some rules to keep in mind.

Using a specialized Bitcoin IRA requires a lot of paperwork. The typical process is to create an LLC in your name, with checkbook control. After creating the LLC, you can choose which digital assets you want to invest in through crypto exchanges. Alternatively, you can choose a more traditional investment, such as stocks or bonds.

Investing in digital currencies can be very risky. High fees can eat up your return, negating any tax savings. Also, you would need to experience a significant gain in order to justify investing in a cryptocurrency. It would be better to hold the digital currency in your own wallet rather than investing through an exchange.

How Much Is The Bitcoin IRA Fee?

The fee for using a Bitcoin IRA varies depending on the company and the user. Usually, a small set-up fee is charged for opening the account, and then there are transaction fees of 2% of the amount of each trade. This fee is higher than what most crypto exchanges charge, which charge less than 0.5% of the total amount of each trade. Although Bitcoin IRA doesn't provide its fee breakdown up front, the company does encourage its users to contact them and ask about fees. In addition to an online contact form, Bitcoin IRA also offers a chat function.

Another option is to use Coinbase, which charges a 1% flat fee for all trades. Coinbase also offers an IRA, though there is a minimum investment amount. While Bitcoin IRA has the lowest fee, this service also has a higher minimum investment amount. The downside is that it requires a hefty tax penalty to withdraw the funds, which may be prohibitive for some people.

Can I Buy Ethereum In A Roth IRA?

If you're looking for an investment opportunity that promises explosive near-term returns, Ethereum may be the perfect choice. This crypto currency is more than a digital token - it's a customizable force on the blockchain. It can give you exposure to the DeFi, NFT, and Web 3.0 spaces, as well as potentially play a large role in the Metaverse.

If you're thinking about opening an Ethereum IRA, you'll probably want to consider a few things. You'll want to choose a provider who will help you pick the right crypto assets for your IRA. These assets are typically stored in secure digital wallets, and they're a great way to diversify your portfolio.

Another draw to holding your investments in an IRA is tax advantages. Those tax advantages make cryptocurrency investment a great choice for a Roth IRA, but keeping track of tax obligations can be a hassle. Every time you sell a cryptocurrency for fiat currency, you'll have to account for the gain or loss from each transaction.

How Do You Get Ethereum In A Roth IRA?

There are three main ways to invest in Ethereum. You can use your IRA savings to buy the cryptocurrency or invest in it through a cryptocurrency exchange. Either way, you must choose a trustworthy provider to make sure that you are getting a good deal. You need to look for a provider with a sterling reputation and a long track record in the cryptocurrency industry.

An Ethereum IRA is an excellent way to add some sizzle to your nest egg without the tax burden. While there is some volatility associated with the currency, it is important to keep in mind that you are investing for the long term and don't need to worry about short-term fluctuations. To make sure you are making the right choice, do your homework on the asset and your IRA custodian. Ethereum has a lot of potential, and it's definitely worth considering.

Ethereum is a new asset that has recently seen some explosive gains. It's not a typical digital token, but it's a customizable force that has the potential to revolutionize the financial sector. It could play a pivotal role in Web 3.0, DeFi, and NFTs. It could even be a significant part of the Metaverse.

Can You Buy NFTs In An IRA?

A non-fungible token (NFT) is a digital asset that conveys ownership of a particular asset. The IRS does not permit you to purchase a NFT in an IRA. This is because they are considered collectibles. If you have an NFT in your IRA, it will be taxed as a distribution. It is also taxable as a form of unusual earnings.

NFTs are not a secure investment. They are not tangible personal property and can skyrocket in value. However, their potential appeal is clear. They can provide a way for digital artists to sell their work and even create a business that can earn them a profit. While they may not be the hidden cash cows of the future, NFTs are an exciting way to invest in the cryptocurrency industry.

To understand how to buy NFTs in an IRA, you need to know how these cryptocurrencies operate. The key is to know how blockchain technology works.

Which IRA Is Best For Crypto? Regal Assets Self-Directed Cryptocurrency IRAs

When it comes to Self-Directed Cryptocurrency Investment Accounts, Regal Assets stands out among its competitors. First, it is a Coinbase-licensed investment company that offers a streamlined platform for investors to allocate their funds to a variety of digital assets. Second, it offers guidance through an account manager who is dedicated to helping clients with their investment choices.

Third, Regal Assets is a well-known and respected firm. Its CEO Tyler Gallagher is a member of the Forbes Finance Council and was named as one of the Inc. 500's top 20 fastest-growing private companies in 2013. It has also been featured in numerous publications and websites. Some of these include Forbes, Cointelegraph, Bloomberg, and Bitcoin Inc. Magazine.

Fourth, Regal Assets is committed to protecting your investments and offering a host of IRA options for investors. They offer gold, silver, platinum, and palladium IRAs, among others. Their team of professionals is experienced in the industry and has been serving customers for 13 years. It also has relationships with vault depository companies and IRA custodians, so it can negotiate the best fees for its customers.

Lastly, Regal Assets offers low fees for IRAs with alternative assets. Their services are free for the first year and they charge a low annual administration fee. However, if you'd like to add more assets to your IRA, you'll have to pay an additional $150 annual storage fee. This is lower than the cost of other similar services.

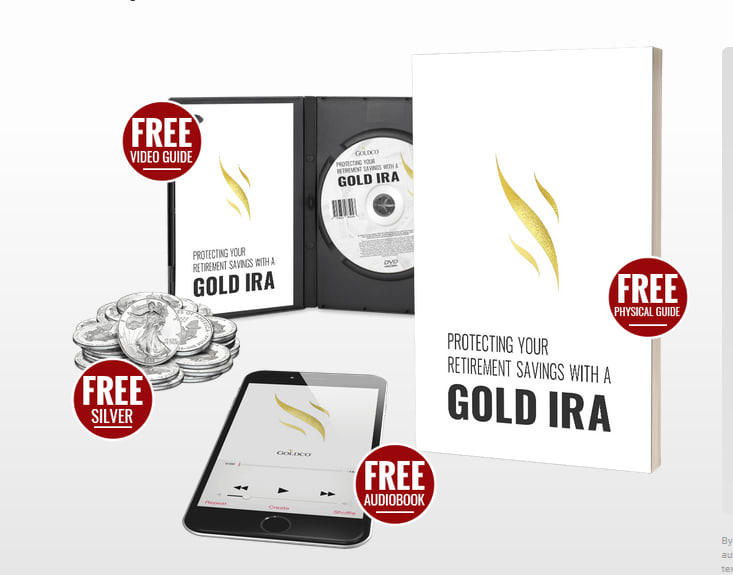

Goldco

Goldco is a leading provider of the precious metals IRA's. They pride themselves in excellent customer service as well the ability in helping individuals to properly diversify your porfolio retirement accounts.

0 comments