Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

In the current market, all retirement investors are encouraged to take the necessary steps to make sure their wealth is protected from inflation, uncertainty, currency debasement, and volatility. This is the reason why many top investors from across the globe suggest converting some of your retirement portfolio into precious metals, which includes gold, silver, platinum and palladium. The process known as a Gold IRA rollover involves transferring a portion of your IRA holdings into bullion or other types of precious metals. This process is also a lot easier than many might think.

In summary, Gold IRAs allow investors to own physical metals such as gold and silver in their retirement account or portfolio on a tax-free or tax-deferred basis. Gold IRA rollovers provide an easy way to create and then fund the account by moving cash or assets from your existing traditional or self directed IRA.

To streamline these processes, we have compiled a guide about Gold Backed IRA rollovers. This will teach you how to easily convert ETFs, bonds, stocks, or any other asset into physical precious metals, within a single tax-advantaged account for retirement. Examples of these include a Traditional IRA or a self-directed Roth.

IRA Rollover To Gold: How To Move 401K To Gold Without Penalty?

As you start getting older, it makes sense to start looking at different ways to put some of your money aside to start saving for your retirement. If you already have a 401(k) from the company that you work for, rolling over part of or all of your 401K into a Gold IRA could be a great choice to attain some of your financial objectives.

To achieve this, you will first need to set up what is known as a Self-Directed Gold Based IRA. When you move your funds for retirement into a Self-Directed IRA it opens up more opportunities for investment such as private equity, private bonds, real estate, and bullion such as silver and gold.

Precious metal investments such as gold, silver, platinum and palladium, have remained one of the popular options since they are a time-tested way to store wealth and they often have the potential to weather various economic changes, providing your portfolio with more stability and diversity.

Precious metal prices often increase during tough economic periods, which means your portfolio will have added insurance against the risks of a financial downturn or crisis.

Similar to other types of retirement plans and 401(k)s, there are a few regulations and rules you need to know about. You will want to avoid rolling over your 401(k) and then be subjected to penalties or fees because you failed to do things properly.

So by now you probably want to know how to move a 401(k) to gold and not be subjected to any penalties. In this guide, we will explain what a 401(K) is, its benefits, the way it works, and the most effective way to roll a 401(k) to gold.

Introduction To Gold Investing

In the world we live in today, the investors that are the most successful use precious metals as a protective hedge against unpredictable economic times that primarily arise due to political upheaval and inflation. Many professional and experienced investment advisors will often tell you that you can mitigate the risks of your retirement portfolio by including commodities such as precious metals in the investment.

If you are interested in investing in gold, there is the option of bullion (certified gold bars), mutual funds, mining companies, futures, or jewelry. However, in most cases, you will only be able to invest directly in bullion, some futures, or specialty funds.

In this informative guide, we hope to help you to understand the benefits and dynamics of transferring a portion of your 401(k) retirement portfolio into a certified Gold IRA investment. This is a process that goes by the common name of a Gold IRA Rollover.

What Is A 401(k) Plan?

Section 401(k) of the IRC (Internal Revenue Code) allows people to regularly make contributions into their retirement account (in a tax-deferred manner). This will mean that you won't be liable for taxes on these contributions until you decide to take this distribution out when you retire (from the age of 59-years and 6 months or later).

Here is a list of guidelines about 401(k)s set out by the IRS:

- Employers are permitted to contribute to the accounts or employees through matching.

- Elective salary deferrals will be excluded from the taxable income of the employee (except for designated Roth deferrals).

- Distributions along with earnings will be included in the "taxable income" at retirement (except for distributions that are qualified of designated Roth accounts).

Employer matching is one of the valuable ways for employees to save extra funds for retirement when the employer provides that plan. Some people even refer to this option as "free money".

If you are currently contributing to your 401(k) fund, keep in mind that the business that is managing your fund will take fees from the 401(k) even when you are not contributing. Over the years, these fees could increase to a drastic amount if you are not regularly contributing money. One of the easiest ways to escape these fees is to use a 401(k) rollover, where you transfer your assets into a Self Directed Individual Retirement Account to provide you with even more investment options.

Similar to IRAs, the 401(k)s are also subject to RMDS (required minimum distributions), which will require an investor that is 72 years of age or older to take out a specified distribution amount each year. The global Covid-19 pandemic has resulted in the US Congress passing the CARES Act, which has waived RMDs for the year 2020. Yet, you should still be aware of the right way to take RMDs to make sure you avoid any penalties going forward. We will discuss this throughout the guide on the right way to transfer a 401(k) to gold while avoiding penalties.

The Benefits Of A 401(k) Plan

Easy to Save | Matching | Tax Deferrals | Borrowing for Emergencies |

|---|---|---|---|

|

|

|

|

Automatic withdrawals

| Employer | Tax-deferred | Potential for |

Easy to Save |

|---|

|

Automatic withdrawals |

Matching |

|---|

|

Employer |

Tax Deferrals |

|---|

|

Tax-deferred |

Borrowing for Emergencies |

|---|

|

Potential for |

There are several benefits to 401(k) plans, some of these include:

- Allowing an easy way for an employee to save money by withdrawing directly from their paycheck into a retirement account.

- Tax-deferred contributions which mean that money that is contributed into an employee's 401(K) won't be taxed. For example, if you earn $45,000 a year, and your contributions work out to $5,000, the amount that will be taxed is $40,000, which means you will be paying less tax on the money you have earned. However, you will still be liable for taxes on this amount once you withdraw from your retirement account.

- Employer matching contributions can help individuals to build a "nest egg" for their retirement.

- The potential to borrow from a 401(k) to fund an unforeseen medical emergency, funeral, or burial expenses for a family member, to stop an eviction, to buy a home, to repair damages to a principal residence following specific casualty losses. This may be an option, but it could cause you to lose market gains on your distributions.

To make the most of these benefits, it is also a good idea to include a Gold IRA Rollover. When you know the right way to roll your 401(k) over into a Gold IRA, this will result in maintaining the above-mentioned benefits that come with tax-advantaged retirement plans, and reassurance that your investment is also secured in reliable precious metals.

What Is A Gold IRA Rollover?

A Rollover IRA stands for an Individual Retirement Account funded by any moving funds that come from a 403(b), TSP, 401(k), or any other similar retirement plan into an IRA. The primary difference between an IRA and a 401(k) is that IRAs are typically opened by individuals as opposed to an employer offering them to an employee.

With Rollover IRAs, investors often use retirement funds that exist already to gain access to a wider range of opportunities for investment when compared to what is available through a 401(k) investment alone. When investing in self-directed IRAs, the investor has more investment options, including a Gold IRA Rollover.

The Rollover IRAs are commonly created when retiring or changing jobs, as they provide a way for individuals to transfer their existing 401(K) or any other balances in a retirement account into one IRA account. This often provides a wider range of investments along with better performance.

When conducting an IRA rollover, the funds in a tax-advantaged existing account can be moved (rolled over) into an IRA tax-free account. It is also possible to roll over money from more than one retirement account into one self-directed IRA, which makes it easier to manage and consolidate your savings for retirement.

With gold IRAs, you can minimize your tax exposure as these distributions are typically subject to standard rates for income tax.

Especially for individuals in a lower-income tax bracket, the gold in the IRA is often taxed at lower rates when compared to when it is not in an IRA.

For investors that invest in a Roth Gold IRA, they won't have to worry about any taxes on their gains when it comes to their bullion (gold) investments.

What Are Gold ETFs (Exchange Traded Funds)

If you already have a Brokerage Account with one of the 401(k) brokerage firms, you are free to invest in all gold options. If you are an employee and you have a 401(k), ETFs (exchange-traded funds) are among the best methods to gain exposure to gold investments.

An ETF allows you as the investor to obtain shares in funds that hold gold physical bullions. You also have the choice to invest in stocks of the companies that are active in the industry of gold when your 401(k) retirement account comes with a "brokerage option".

Gold Mutual Funds

"Paper Gold", or mutual funds is one of the other alternatives when you are not able to invest your funds in "physical" gold. You can go through the fund descriptions of your 401(k) plan to find several mutual funds that offer the potential of significant enough gold exposure. You can achieve "gold exposure" when securing stocks from companies that are involved in gold mining.

Self-Directed IRA Rollover

People often choose self-directed IRA rollovers, when their 401(k) retirement plan is not providing the opportunity to access different gold investments which may help them to achieve their investment goals.

The Self-Directed IRA Rollover option like the one GoldCo offers provides you with many gold investment opportunities, including mutual funds, ETFs, commodity futures, options, and stocks.

Gold IRA Rollover Vs. Gold IRA Transfer

When funding a Gold IRA, there are two options to choose from. These include a transfer or a rollover. Rollovers, simply put, are far more risked-managed and secure strategies to move assets between a savings account for retirement. There are various Gold IRA rollover conditions and rules that investors need to be aware of. If you break one of these rules, you may subject yourself to expensive IRS-imposed penalties.

Gold IRA Transfer Rules | Gold IRA Rollover Rules |

|---|---|

No 60-day transfer rule applies | 60-day transfer effectively applies, where an account holder must do transfer of deposited funds from their own account into the new gold IRA |

Not subject to early withdrawal penalties | Distributed funds attract 10% early withdrawal penalty as long as the account holder is under the minimum withdrawal age of 59.5 |

Not taxable | If violation of the 60-day rule occurs, the distributed funds will then be deemed taxable as ordinary income |

No annual limits apply | IRA holders will be strictly limited to only one rollover per 365-day calendar year |

No withholding taxes apply | Tax withholding is not applicable if a rollover is made from a personal IRA to another IRA |

The Gold IRA transfer process involves moving money from one custodian to another. This means that the holder of the account will not receive funds that are withdrawn from the account. Instead, the money is directly transferred between custodians (third parties) without the involvement of the holder of the account. It is a no-touch, simplified process for an account holder since the process is entirely handled by custodians.

The main difference between transfers and rollovers has to do with funds that are distributed through an IRA transfer will never touch the bank account of the IRA holder. For additional information on how the IRS regulates rollovers, along with the penalties or consequences involved in violating them, here is a useful IRS-authored guide that covers general IRA rollovers. You can also read over the Gold IRA FAQ section directly from Uncle Sam himself.

Can You Roll A Traditional IRA Into A Gold IRA?

You can roll funds from a Traditional IRA into a Gold Roth IRA. However, there are a few guidelines that must be followed before you decide to invest in precious metals such as gold. Some of these include:

- Gold is required to have 99.5% purity and .995 fineness.

- A custodian must be used to hold your gold.

- You cannot add pre-owned gold to your gold IRA, but you do have the option to open a Gold IRA and then buy new gold that you can then add to the account.

A few of these regulations and rules can be found in Section 408(m)(3) of the IRC (Internal Revenue Code). This includes the exceptions and guidelines when it comes to investing in coins and bar bullion. When you know about the basic rules and regulations you can avoid the common pitfall before you go ahead with a Gold IRA transfer.

401k Roll Over To Gold

If you have recently left your employment, especially if you have recently retired and have your 401(k)-retirement plan, you have the opportunity to roll over this 401k plan to gold. As we have mentioned before, this is one of the very best ways to protect your retirement savings from an uncertain future.

It is important to note, that this rollover from 401(k) into a gold IRA incurs no penalties and is non-taxable. Once you have left your place of employment, you can begin rolling over your funds into a Traditional self-directed retirement account (IRA): then you can purchase precious metals silver and gold from this IRA.

You can even begin rolling over while you are still employed at your company. If you have a 401K plan that allows this, you can swap your 401k funds into a gold investment through an in-service distribution option.

What this in-service distribution option entails is the distribution of funds that can then be rolled over into your IRA. The funds that are distributed are not loans. Furthermore, you will not be accumulating any tax consequences if you choose to execute the rollover within 60 days.

But you will have to check with the provider of your 401k plan first to see if this option is even supported if you are using an in-service distribution.

Continue reading this article to find a straightforward step-by-step guide to performing this rollover from a 401k to gold IRA.

The Benefits Of Gold 401(K) Rollover

|  |  |  |  |

|---|---|---|---|---|

Safety from Devaluations | Protection Against | Preservation Against Seizure | Diversification Helps To Manage Investment Risks | Tax Benefits Traditional IRA |

If you choose a regular plan of gold contributions as a component of your retirement portfolio, you will be purchasing actual gold as opposed to just an Exchange Traded Fund (ETF) gold. In other words, you will actually be the owner of the gold as opposed to just having a vested interest in gold.

The benefits of a plan like this include:

- Improved Defense against devaluations in currency.

- Better protection against inflation

- Less susceptibility to seizure by the government

- Diversification to manage risks

- Same tax benefits as conventional IRA

IRS Penalties for IRA?

|  |  |

|---|---|---|

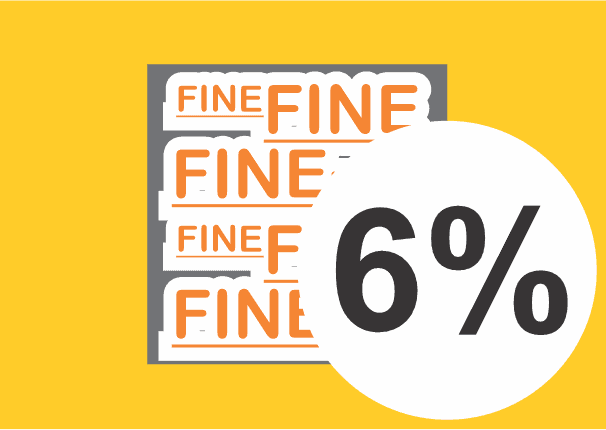

You incur 6% penalty for exceeding the contribution limits | Investing in collectibles is not allowed if you have a self-directed IRA | You incur a 10% penalty plus income tax for withdrawal of any distributions before the age of 59 1/2 |

The IRS has set down some penalties that you should be aware of that apply to those who are not following regulations for the different types of retirement savings. Here are some of the rules set down by the IRA. It is important to be aware of these so you will know when and how to properly move your 401(K) into gold without incurring penalties.

- If you surpass the limits of your contribution, you may incur a penalty of up to 6%. For example, if you contribute $500 over the limit, you will be penalized $30 each year until the error has been corrected.

- If you have an IRA, you are not allowed to invest in collectibles or certain valuables as outlined in the IRS section 408(m)(2). This includes things like collectibles, rugs, stamps, artwork, antiques, etc. If you do, you can incur certain penalties. But this limitation does not apply to precious metals like gold and silver, etc.

- You can also be penalized 10% and income tax if you begin withdrawing distributions before you have reached the age of 59 and ½ years of age. There are certain exceptions to this including the death or disability of the owner of the IRA. Also, withdrawals for specific medical expenses, higher education expenses, first-time home buying down payments are also exceptions. Furthermore, the CARE Act of 2020 has made it possible to withdraw as much as $100,000 so long as you are a qualified individual. You can also qualify for the CARE allowance if you, your spouse, your dependent are diagnosed with COVID-19 or if you have been experiencing financial difficulties because you lost your job, encountered an extended furlough or lack proper childcare.

Deciding on a Gold IRA Rollover Strategy

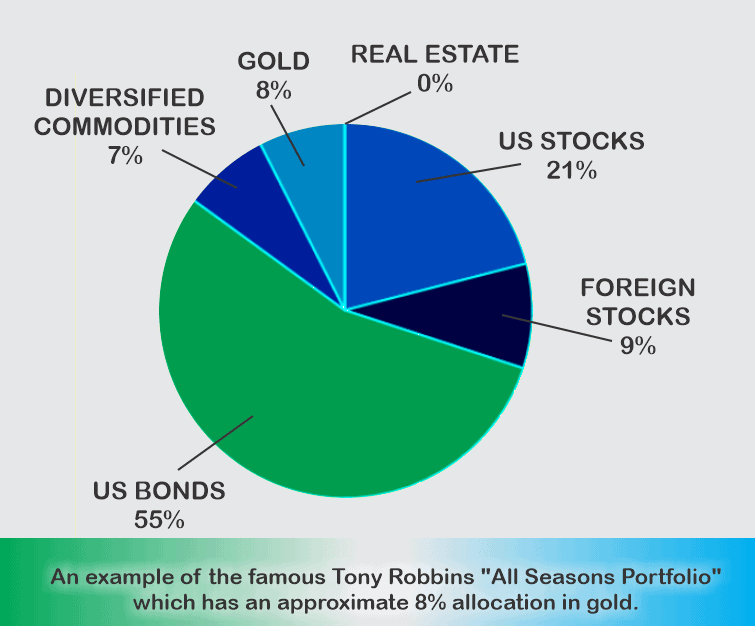

There is no simple solution that will apply to all Gold IRA Investment plans. The only way to make a good decision for your needs will be to carefully examine the nature of your financial plans and then proceed to finding a proper roll over strategy that caters to the funding account you have chosen. Another common question we hear from our readers is concerning the percentage of the portfolio that should be allotted to the Gold IRA investment account. The only answer we really have here would be that there is no simple answer that will work for everyone’s investment plans and it's really on a case by case basis as different individuals have different retirement goals.

The quantity of your personal funds that you will choose to invest in precious metals will depend largely on the risk tolerance you have and the proximity of retirement There are investors who prefer not taking a major risk and who are within a decade of their retirement. These investors may consider dedicating more of their investment portfolio to precious metals, even between 15% and 20%.

Choosing Your Gold IRA Allocation

In summary, some of the most accomplished investment advisors in the world will offer the 5 to 10% rule. This includes legendary names like Tony Robbins, Ray Dalio, Kevin O’Leary, and more. But there are other advisors with a higher aversion to risks who will suggest that you should go beyond this mark. Here are some of the most important questions that will dictate your decision-making process.

- What’s the outlook on the economy for the next 5-10 years?

- Has my portfolio been performing as I have expected for the past 5 years?

- What’s my purpose for investing in precious metals?

- How close am I to my retirement date?

The third question is one of the more important ones and should cause you to look deep within yourself to find the best answers. In most cases we have found that our readers will fall into three categories of investors with different reasons for opening a gold IRA.

Diversification Orientation

Diversification refers to those who are looking to invest in precious metals to hedge their portfolio from overexposure to fluctuations in stocks, bonds and other traditional assets. Many of these are risk-conscious investors that will be looking to diversify their funds so as to reduce the risks of potential losses or the event of a sudden market downturn or some other sort of recessionary event.

In this orientation, it is a good idea to stick to a 5% to 10% limit of precious metals allocation. This means that investors should allocate roughly this amount of their portfolio’s total value to holdings in precious metals.

Inflation and Debasement Orientation

Then there will be those investors investing in precious metals out of greater concern for the debasement of currency or widespread inflation. Gold has long been considered the best hedge against inflation and here is where a gold rollover can protect the investor from a declining economy.

Investors looking to create a safe place from the threat of inflation should consider increasing their investments in precious metals. A good figure for allocation would be between 10% and 20% in gold, silver, platinum and other precious metals. If the dollar continues to do poorly, those who have protected their investments with precious metals will fare better than those who have not.

Systemic Collapse Orientation

Then there are those who are concerned about the overall state of the global economy and whether or not it will be well sustained in the future. This is another good reason to invest in gold and other precious metals. Gold and silver are also excellent disaster hedges, this is because in times of disaster their value tends to rise accordingly.

Those investors looking to gain a form of systemic protection against the advent of war or other social upheaval would do well to invest in precious metals. This will be the top of the allocation scale with an ideal percentage lying in between 20% and 30%.

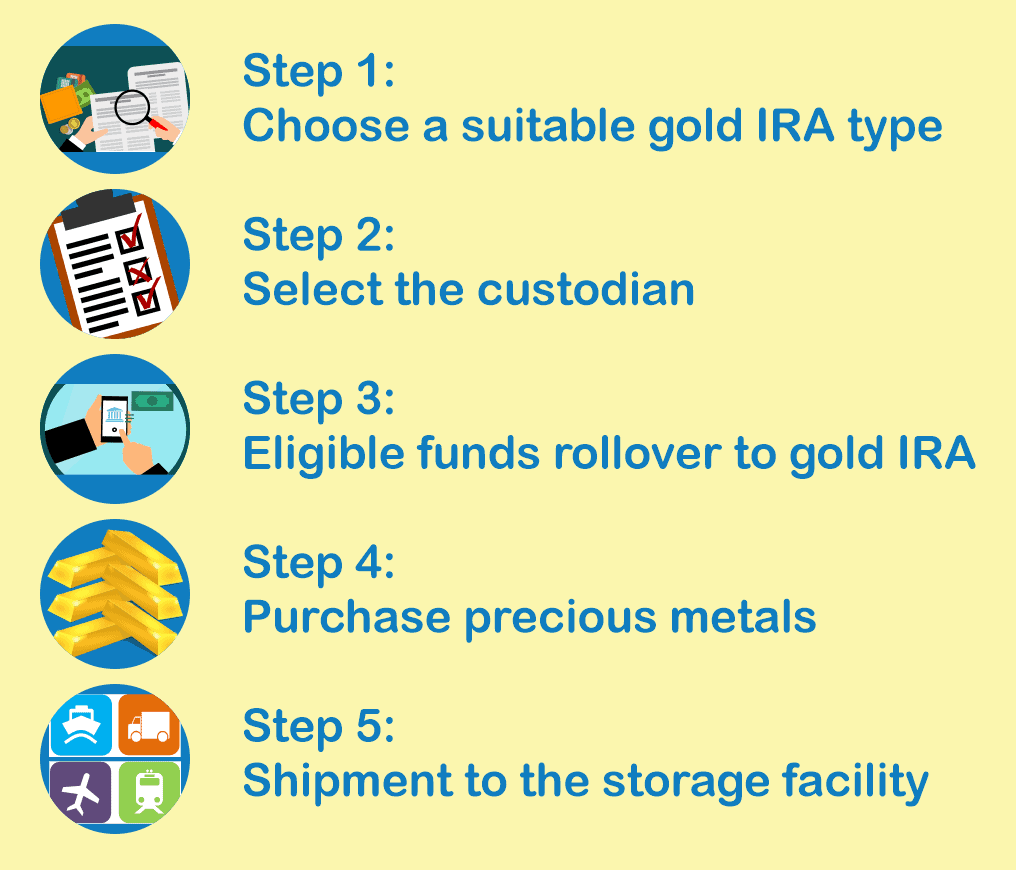

5 Steps for How to Transfer a Conventional IRA Into a Gold IRA

If you are new to the task of transferring to an IRA, also known as rolling over a 401(K), or more specifically making a gold IRA, here are five steps to make this process a little easier. As always, you will want to keep the guidelines laid down by the IRS in mind when making rollovers and distributions to make sure you do not step over any regulations.

How you can rollover to gold IRA from 401k?

Step 1: Choose a suitable gold IRA type

The first thing to do will be to choose which types of Gold IRA is best for your method of using IRA funding. This involves choosing between two primary options. There is a conventional IRA which uses pre-tax dollars and a Roth Gold IRA which applies post-tax dollars. Most of the 401k to gold rollovers have accounts that are funded with pretax dollars.

Step 2: Select the custodian

There are many different custodians you can pick for your 401k to gold rollover. But you should know that most of these will only be able to help you with traditional investments and you may need to find a custodian with self-directed options.

If you are looking to invest in precious metals, look for a custodian offering accounts that allow for precious metals holdings. An ideal custodian will also be able to organize holding and storage because the IRS is against investors holding their own physical gold.

Step 3: Eligible funds rollover to gold IRA

Once you have opened an account and done the proper paperwork, the next step will be to rollover your 401k eligible funds to your IRA. Begin this part of the project by contacting a 401k administrator and letting them in on your decision to roll over your IRA.

Your administrator will provide you with the needed paperwork that must be completed before the IRA account can be properly funded. Never forget that once you receive your money, you will have a time limit of 60 days to get it into your IRA account, if you hope to take advantage of your tax-free rollover.

Step 4: Purchase precious metals

Once you have completed those steps, it will be time to add your gold to your account. Remember that you can only purchase gold of 99.5% purity or coins and bars that have gotten the approval of the IRS.

Step 5: Shipment to the storage facility

Once you have made your purchase, the precious metals dealer will send the invoice to your IRA custodian requesting payment. Shipping of your precious metals will begin once that transaction is completed. You will want to check and make sure that precious metals have arrived at your custodian’s depository.

While starting the process, it is important to keep in mind that only IRA-approved gold will be eligible. The best practice is to make sure you contact a qualified gold IRA specialist because understanding all the nuances of self-directed IRA program and rolling your 401(k) into a gold IRA are critically important.

The Downsides Of Rolling A 401K To An IRA

The 401k Rollover to a Gold IRA is not suitable for all investors. Here is a list of a few of the downsides:

• Stable Value Funds

The Stable Value Funds are special types of funds accessible to the company 401k plans. These funds are similar to money market funds, but they are not available in individual markets. The stable value funds, unlike the money market funds, provide more favorable interest rates.

• Withdrawal Tax Rules

When your 401k is invested in one of the companies that have high appreciating stocks, it is possible to achieve unbelievable tax savings when you transfer your stock into one of the brokerage accounts. The initial price of company stocks your 401k purchased will determine the taxes even if those stocks appreciate.

• Higher Account Fees

Company 401k plans are able to access institutional investment funds. These are low-cost funds that attract lower fees since the buying power is higher.

• You Are At Risk Of Losing Creditor Protection

401k plans provide federal law protection when it comes to credit and bankruptcy. IRAs, on the other hand, are protected from different state laws. For this reason, IRAs do not offer a lot in regard to collections, creditors, or potential judgments.

• No Loan Options Available

If your employer sponsors your 401k plan, your chances improve when it comes to securing loans. If you decide to roll over your 401k plan into IRA, the likelihood of securing a loan becomes extremely limited.

• There Are Requirements For Minimum Distribution

It is possible to access the funds in your 401k plan from the age of 55 years, but the funds in an IRA proram only become available from the age of 59.5 years of age. If you do not fulfill this requirement and you decide to withdraw your funds out earlier, you could risk a penalty of 10% for an early withdrawal.

Gold IRA Rollover Should Include IRS-Approved Bullion Bars

The IRS has strict standards when it comes to the gold asset types that are allowed in tax-advantaged retirement accounts. For the comprehensive list of holdings that are authorized, refer to the following guide to IRS-approved Precious Metals. These include, but are not limited to, these gold asset types:

- Johnson Matthey Gold Bars

- American Eagle Gold Coins

- Valcambi Gold CombiBar

- Credit Suisse Gold Bars

- Canadian Gold Maple Leaf Coins

- Canadian Silver Maple Leaf Coins

- Austrian Gold Coins

For every case, collectibles are not allowed from any 401(k) or IRA, per regulations set out by the IRS. Rare coins or other precious metal types listed as "collectibles" under IRC Section 401(a) are strictly prohibited from IRAs. As a general rule, bullion bars produced from gold are not listed as collectibles. When it comes to gold coins, there are few exceptions that will allow for investing via a Gold IRA Rollover:

- Coins listed under 31 USC Section 5112

- Bullion or coins that are held by a non-bank trustee or a bank

- Coins issued and minted under laws applicable to sovereign states

Investing in assets that are not approved may lead to fines or penalties. To stay on the safe side, it is best to rather invest in bullion instead of rare coins. If you do want to buy gold coins, ensure that you review the list we have provided of the Top IRA-Approved Gold Coins.

"Paper Gold" Rollover Vs. Physical Gold IRA Rollover

There are currently two main ways to expose yourself to gold. The first is physical gold. This includes metal bars or coins stored in a secure vault by third-party, trusted custodians. The second type is known as "paper gold". This describes all gold-based security types, including ETFs or gold mining stocks.

In addition to convenience, it is easy to see the advantages of "paper gold" as opposed to physical metal bullion. Even though some of the investors prefer gold stocks since they provide more liquidity, these options represent a "double-edged sword" since an increase in liquidity also makes it a lot easier to sell and buy these assets quickly.

For this reason, "paper gold" is often more volatile when compared to real metal commodities.

The physical Gold IRA rollover is the best way to experience the true exposure you can achieve from gold investing. Should inflation rise rapidly or an economic collapse, if you own gold stocks, their worth may drop to the same value of the paper they were printed on.

Do you still need more convincing? Keep reading to find out more about the best benefits linked to investing in physical gold in comparison to security-based gold exposure.

• Safe Haven Store Of Value

In the event of an economic crash or crisis, gold bullion in physical form still holds its value, even when paper assets or cash become worthless.

• Counterparty Risk

Unlike publicly traded stocks, gold bars will still fulfill contractual obligations and cannot be declared bankrupt. For this reason, investors that buy physical gold are not subjected to the counterparty risks that investors in paper gold may face.

• Movable and Transferring

Gold bullion is not only portable but can also be withdrawn from IRAs into a vault or your own possession.

• Physical Ownership

When you own physical gold, it is a lot harder to seize or confiscate them when compared to electronic-based assets.

How To Find The Best Gold IRA Custodian

When opening a standard Roth or Traditional IRA, all that is required from your side is to find your closest Fidelity Investments or Vanguard branch so that you can secure a spot for your new IRA. Gold IRA Rollovers are slightly more complex than that.

Charles Shwab and Fidelity which are both conventional brokerages do not support Gold IRAs. Before opening a Gold IRA, you must review and choose a Gold IRA custodian. These are companies that initiate and then facilitate your Gold IRA Rollover with your current 401(k) or IRA provider.

Trusted Gold IRA companies will be completely transparent, providing you with the necessary documentation and paperwork to complete your rollover, without hidden fees or clauses.

If you need a bit more guidance, refer to this guide covering the World's Most Reputable Gold IRA Rollover Companies. After reading this guide, there are also a few ground rules you need to know about when you start looking for a Gold IRA custodian. These include:

#1 Prestige And Reputation

It makes sense that companies with the best customer satisfaction and reputations are vital when you start looking for a Gold IRA provider. There are a few companies that have malicious intentions known for preying on unsuspecting consumers.

Stay away from the precious metal companies that aren't well-reviewed online. The customer-generated reviews that appear on Google My Business, YouTube, Reddit, Trustpilot, and the BBB (Better Business Bureau) are the best sites to find authentic, reliable reviews and customer testimonials.

It is important to know that only the IRS-approved nonbank-trustees are allowed to operate precious metal vaults. If the custodian is not IRS-approved, it is best to look for other options. Some vendors are known for trying to sell numismatic coins or gold of low purity that are not IRA authorized.

#2 Rollover Limitations

The IRS only permits a single penalty-free rollover over a period of 365 days. For example, if your rollover was completed on July 1, 2021, in order to initiate the next tax-free rollover, you would need to wait until July 1, 2022. For this reason, it becomes important to choose the right custodian. If you make the decision to change your custodian before the 12-month period has passed, you will be liable for early distribution penalties, should you decide to roll your funds over once again.

List Of The Best Gold IRA Companies

Today there is no shortage of precious metal IRA companies to choose from, making it harder to find the right company to match up to your needs. This is why we have put a list together of the most reliable and bestselling companies in this sector. Each of these companies has been in business for multiple years and have a stellar reputation.

In most cases, it costs between $100 to $325 for storage fees from reliable providers. Some of the companies like Regal Assets don't charge transfer or rollover fees and they also waive storage and administrative fees and costs for the 1st year.

Account Types That Are Eligible For A Gold IRA Rollover

To successfully complete your Gold IRA Rollover, you can use any type of tax-advantaged retirement plan to transfer funds. These include:

- Self-directed 401(k)

- Roth or Traditional IRA

- SEP IRA

- Employer-sponsored 401(k)

- 457(b)

- 403(b)

- TSP

When it comes to an employer-sponsored account, including a 457(b) or 401(k), you might be required to facilitate your rollover once you are no longer working for that company. In certain cases, you might be allowed to perform a "partial rollover" if you are still employed once reaching the minimum age of 59.5.

Transferring funds from your existing plan into a new Gold IRA simply involves registering a self-directed IRA through your chosen Gold IRA provider. From here, complete the transfer request document to initiate the rollover of your funds. This usually won't take longer than 14 working days and the funds should appear successfully in your new IRA.

Reasons To Purchase Gold With Your 401K

As we mentioned above, gold is among the best choices if you want to diversify your retirement or investment portfolio. Below are some of the top reasons to consider purchasing gold bullion with your 401(k):

• Transfer Without Any Penalties

Rollovers from 401(k) retirement plans to gold IRA investments do not attract penalties and are non-taxable. At the same time, when switching between each option, your custodian will facilitate the entire process, which means you won't have to worry about additional charges.

• Security

Gold is known as a secure investment when it comes to political turmoil or inflation. This is the reason why many experienced investors prefer using physical gold as a protective hedge during times of turmoil or crisis. In general, gold increases in value when other currencies start losing their value.

• Gold Has Intrinsic Value

Gold is often unaffected during an economic crisis since it has intrinsic value. This means that it has an application in "real life". For example, it is used by manufacturers that produce mobile phones and computer chips. That makes gold a sound and protected investment.

• Easy To Rollover

It is possible to use your assets in an existing retirement plan to fund your Gold IRA. If you already have a 401(k) account, it is very easy to purchase gold via a rollover.

The Reason Gold IRA is Right for Investment in 2021 and Beyond

The COVID-19 pandemic in 2020 caused a stock market crash but gold continued to show a bullish trend, in spite of the market crash. According to most analysts, as more and more economies continue to become weak because of the pandemic, gold will continue this bullish trend.

As a matter of fact, with the onset of Covid-19, gold did even better than the highest prices that were witnessed in 2012. This was due to the extreme volatility of the market that caused investors to choose the safety of gold investment to escape the volatility.

A price increase was predicted by some analysts in the first half of 2021, which was to be followed by a decrease. There are, however, other analysts who are adamant that the bullish trend of gold will carry on into the year 2022.

On the whole, gold IRA will, in 2021, be a good investment as not only is the gold price showing a gradual rise, but also because in uncertain times, gold has always been considered to be a safe investment. Even as most country currencies continue to be affected by the market volatility, gold will continue to maintain a reliable trend.

An early forecast made by the London Bullion Market Association (LMBA) said that throughout 2021, gold prices would average $1974 per ounce. This shows an 11.5% increase from the annually average recorded high that was seen in 2020.

Four of 2021's top gold investment companies have been reviewed by us for your reading pleasure and knowledge.

Contribution Limits For An IRA

Establish a rollover IRA, and you can contribute to it just as you do in a traditional IRA.

Once a rollover IRA is established and you have begun making contributions, it will inhibit you from being able to reverse it to take you back to a 401(k). So you must evaluate all possible options before you make any changes.

Contribution limits for IRAs have been laid down by the IRS, and these have to be strictly followed, so that you are not penalized for any default. Understand the gold IRA contribution limits by following these guidelines:

- All traditional IRAs have a limit of $6000, which increases to $7000 if you are over the age of 50 and the same limit applies to a gold IRA.

- This limit is across all the IRA accounts you have, so the total of $6000 is the total across all your accounts.

- The contribution limit is per person, and not each account, so that potentially you can contribute in a year to any number of accounts.

- If you are more than 50 years old, you can contribute additionally to a 401(k). For 2020, the limit for a catch up contribution is $6,500.

FAQs About Gold IRA Rollover

With a gold IRA rollover, it's possible to convert a portion of an investment portfolio or retirement account to gold bars or bullion. This can be a way to protect your investments against inflation or a precarious economy.

When it comes to an indirect rollover, your existing 401k company will send you a check for the balance of your retirement account, which you can deposit into your personal bank account. It's important to note that you must re-deposit those funds into your new Gold IRA, within 60 days to avoid penalties. Most 401k companies will allow you to initiate your gold IRA rollover right over the phone.

At times, any funds that you move from any retirement account to any other account is called a "rollover". IRS, however, distinguishes between rollovers and transfers. When you rollover, the money moved out is paid to you and you can then deposit this money into another account. In a transfer, the custodian of your original IRA transfers the funds to the custodian of the new IRA that you have designated for receiving the funds. You will never see the money personally.

The most common method to establish a self-directed IRA, as gold IRAs, are with existing and qualified funds that come through a custodian to custodian transfer. To establish a fresh account you have to do so with an IRA custodian who is IRS approved, who then has to be given your consent to request for the transferring of the IRA asset from any retirement account that is existing. The custodian is then enabled to accept money, and will invest in any assets as per your specific and explicit instructions.

In addition, if you choose to go with a rollover, it is always better to perform a rollover directly instead of indirectly. There can be early distribution penalties and withholding requirements in indirect rollovers.

IRS rules and regulations are quite stringent for Gold IRA accounts. The most important of these is the rule that pertains to self-directed IRAs, that Gold IRAs are, and federal law requires you to start this type of retirement account only through an approved IRA custodian. A critical point to note is that your buying of gold or any other precious metal cannot be done personally. IRS rules require this has to be done by the IRA account administrator. You are just required to give the custodian clear directions so that they can start the purchase of the precious metals. It is they who will conclude the transaction while also making the needed arrangements for its shipping and insurance.

Once the purchase of the gold has been made it has to be stored as per the regulations the IRS has for Gold IRA and other precious metal IRAs. The custodian of the Gold IRA that you have, will receive the precious metal and then give them to a third party, sanctioned by the IRS. This third party must have an accredited off-site depository. You have the option of selecting the depository, or you can use one that the administrator already has a relationship with. This accredited depository will inventory and hold your gold safely, till the time you give explicit orders to the administrator of your account to either sell your gold or hand it over to you. When this is done, the distribution will be at your home address by a delivery that has the necessary insurance.

Rules for an IRA rollover laid down by the IRS are quite stringent. As per these regulations, if your Gold IRA is rolled over you have 60 days to deposit the money from the date you receive the funds, to deposit them with the chosen Custodian or Gold IRA company. If you fail to do this in the stipulated period of 60 days, this withdrawal then becomes taxable and can also result in an early withdrawal penalty of 10% if you are under the age of 59 1/2. There is no tax withholding if you withdraw funds for this rollover from a personal IRA to another IRA. This can only be done once a year.

If the transfer is directly from custodian to custodian, the 60 day rule will not apply as you do not receive the money. The custodians accomplish this exchange through wire transfer directly between them. The original IRA custodian can also transfer these funds by check made out to the receiving custodian and mailed to him. This is the easy way for investing in gold, as your existing and new custodian handle it in the background.

The government has not sanctioned any transfer or rollover fees for moving a traditional IRA that exists to a Gold IRA or precious metal IRA. Some fees may be levied for the account application. Sanctioned administrators and custodians of precious metal IRAs charge a fee for opening and starting an account for Gold IRAs or self-directed IRAs. The fees charged can differ from administrator to administrator, but the average fee for this particular category is $50.

A 401(k) can be rolled into an IRA or Individual Retirement Account or any other plan that qualifies without having to pay any tax penalties. These are the 401(k) rollover rules:

* Once you receive funds for a rollover from your 401(k) account, you have to complete the process within 60 days. If you do not adhere to this timeline, your money will be treated by the IRS as a distribution that is then taxed. And if you are not yet 59 1/2 years old, you may also have to pay a penalty of 10% for the withdrawal, which is in addition to the normal income tax.

* There is a limit of one rollover per year from 401(k) to an IRA. This year starts from the day you have received the distribution for 401(k). This is applicable to every IRA that you have.

* The cash received from your distribution cannot be used for purchasing any investments during the period that elapses between the distribution form 410(k) and your establishment of an IRA. You are better advised to carry out a direct rollover with the funds you receive from 401(k). In such direct rollovers you will not receive any check for the distribution, but your provider of the 401(k) plan will make a direct money transfer to your new IRA plan.

The types of gold and precious metals allowed in an IRA are strictly regulated by the IRS. An investor can hold gold bars, bullion, and coins that must meet two basic standards. A public entity must have the gold as its official currency and meet a set purity standard. The United States has a purity standard of 0.995. Every country has a different standard, so that means that you must research this to determine the required purity level. Physical gold that can be part of a Gold IRA or self-directed IRA are:

* The American Gold Eagle coin

* The Austrian Philharmonic gold coin

* The Canadian Gold Maple Leaf coin

* The American Gold Buffalo coin

* Credit Suisse Gold Bars

* Gold Kilo Bars

* Certain Gold Bullion Bars

* Swiss PAMP Gold Bars

- Goldco: Best overall gold ira company.

- Birch Gold Group: Best reviews for a gold ira company.

- Augusta Precious Metals: Easiest setup for a gold ira.

- Regal Assets: IRA company with the Best reputation.

- Noble Gold: Best gold buyback program.

Gold IRA companies are firms that specialize in the complete process of the set up of Gold IRAs, including any IRA transfer/rollover. The components that these companies are required to deal with are setting up the IRA account, purchasing precious metals approved by the IRA,and arranging their storage at depositories that are IRS approved. Any reputable Gold IRA company must have the ability to handle the complete process for you and answer any queries that you have. Usually, most of these companies form alliances, as part of their strategy, with IRA custodians, wholesale metal dealers, and accredited depositories.

To choose the best one you need to be clear about the factors that carry importance to you. It can be anything from storage options, ratings, physical location, availability of alternative options for assets, or customer service. Once you decide the factors that are of concern to you, make a list of the few companies that meet your needs, and call on them. Alternatively you can ask for more details about their company and its products by asking for their free gold kits that give this information. Some reviews of the top Gold IRA companies given below should give you an idea of the available options.

Note: Do your due diligence and and recommend that you then call on the companies in your short list before you decide on your investment. Before investing in any class of assets, advice from your financial advisor should be asked for.

If this is something you're considering, you should be aware that rolling a 401k into a gold IRA does not lead to penalties, and the funds cannot be taxed. If you're leaving a company, you have the option of rolling your funds into a self-directed Individual Retirement Account (IRA). The IRA can then be used to purchase gold or silver.

Metal investments are a way to keep the money you've saved for retirement safe. Instead of being backed by the dollar, your investment will be backed by tangible gold. Best of all, moving your money over is a very simple process.

If you want to transfer IRA money into silver and gold, your first step will be rolling funds from a traditional IRA to a self-directed IRA. You won't be subject to penalties or taxes providing that the money transfers from the first IRA to the second account in under 60 days.

It's possible to buy gold and silver ETF shares with IRAs. You also have the option of investing money in a trust that holds gold. While there are rules against investing in gold directly with an IRA, the newest PLR states that these rules are not applicable to independent trusts that hold gold.

You won't be expected to pay taxes on any gains from your gold investments until after you cash out your IRA. From there, the gains will be taxed with a marginal tax rate, just like income usually is. With gold IRAs, however, there are more frees and taxes to consider. If you cash in your IRA before you turn 60, you'll be subject to a 10% penalty for early withdrawal.

You'll be able to take possession of your investments when you reach the end of your IRA term. After you are 59 years and 6 months old, you'll have the option of liquidating any precious metals in your IRA for cash. Alternatively, you'll be able to physically possess the silver and gold you've invested in without any penalty.

- Choose a Custodian for Your Self-Directed IRA: It's necessary to have a custodian to hold your self-directed IRA.

- Select a Precious Metals Dealer: Once you've chosen a custodian, you'll need to find a precious metals dealer.

- Choose the Products You'd Like to Buy

- Select a Depository

- Finish Your Transaction

There are financial experts that believe gold is risky to invest in. Because silver can be volatile, the risk is even higher. These experts believe that retirees are better served by investments that produce income. If an asset can change dramatically in value in a short period of time, or doesn't grow for years, it may not meet a retiree's needs.

With that said, if gold is held on a long-term basis, it delivers returns that are marginally above inflation. This means that gold can be a way for investors to keep inflation from impacting emergency funds. Liquid funds and bank accounts may not provide the same level of protection.

Gold can also be a way to protect funds against deflation, as well as a way to diversify your portfolio. Because gold is valuable across the globe, gold can keep funds safe during uncertain times.

Precious metals or gold IRAs are a type or IRA that allows approved precious metals, including physical gold, to be kept in custody for the owner of the IRA account. The function is similar to that of a standard IRA, but the account holds physical gold bars or bullion coins and not paper assets.

There are fees associated with gold IRAs. Potential fees may include a storage fee and a set-up fee. You may also be expected to pay a management fee to your chosen account custodian. In the first year, fees are likely to between $250 and $350. In subsequent years, you can expect fees from $150 to $250.

Many investors wonder if it's possible to purchase gold in a Roth IRA. In most cases, owners will be required to choose between mutual funds, stocks, and bonds when making investments. However, this isn't the case for a Roth IRA that's gold-backed and self-directed. With an account like this, you'll be free to hold bullion and coins providing that they are approved.

Get Started With Your Gold IRA Rollover

For the protection of your investments you should ask the question of how you can arrange a 401(k) rollover into a Gold IRA without attracting any penalty. The ideal way for conducting a Gold IRA transfer is to work with experts in precious metals investing. They are the people who can offer valuable reference materials, besides answering your questions , help in filling out forms, and help you to make a choice of the right precious metal for your account.

These Gold IRA companies are always keen to help so that you can diversify your investment portfolio and be in greater control of your future finances.

0 comments