Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

How To Buy IRA Gold?

When it comes to choosing a company to hold your gold IRA, you should consider several factors to ensure accurate gold ira comparison. While the Better Business Bureau and Business Consumer Alliance can give you a good idea of whether a company is legitimate, you should not rely on historic legal action to automatically discard a gold IRA company. Many states are notoriously trigger-happy when it comes to regulation, and a bad company's history may not reflect their current performance.

What Banks Offer Gold IRA?

What banks offer gold IRAs? These accounts are not as popular as traditional retirement accounts, but the advantages can outweigh the costs. A gold IRA requires you to allocate a greater percentage of your investment portfolio to precious metals, which is often more than most financial advisers recommend. Additionally, you must invest in gold-IRA compatible bullion that has been IRS-approved. Here are some of the things you should keep in mind before opening an account with one.

To open a gold IRA, you should start with a small initial investment. Most companies require at least $50,000 for your account, but some companies don't advertise these limits. You should also be aware of any initial account setup fee, which typically ranges from $50 to $150. Luckily, some companies waive the initial fee if you put in a larger deposit. But be sure to ask about fees and investment limits before you invest.

There are several types of costs associated with holding a gold IRA. The annual administrative fee covers the costs of keeping your account open year after year. This fee varies by account size. Storage fees are charged by the depository that stores your investment. Some depository custodians charge a flat annual fee, while others base it on the value of the gold you hold in your account. You can also pay a commission on the gold you purchase.

If you're looking to invest in gold or silver ira, you may have heard of Augusta Precious Metals. A gold IRA is one of the best ways to get started investing in precious metals. In fact, gold and silver IRAs are the most popular types of IRAs and are commonly used as a hedge against inflation and diversifying savings. However, if you're not sure how to invest in gold and silver, you might want to start by learning more about them and their services.

One of the most important factors to consider when deciding whether to invest in gold or silver is whether the company is reputable. Augusta Precious Metals has an A+ rating with the Better Business Bureau, which is the number one resource to assess a company's reputation. Having a high-profile client list is also a good sign, and a recent report revealed that NFL quarterback Joe Montana chose Augusta as his personal financial advisors.

The company's headquarters are in Casper, Wyoming, but it also has a satellite office in Beverly Hills, California. It also has a celebrity spokesperson - Joe Montana. Besides being a gold bull, Steele has a passion for precious metals and has endorsed Augusta Precious Metals. The company's services are also recognized by the United States Mint.

If you are looking to invest in gold, but are unsure how to go about it, you can check reviews of the Goldco IRA Company online. Many customers have given Goldco a high rating, while others have given negative ones. Consumer reviews are helpful because they show the fees and the overall experience with the company. In general, reviews about the company are largely positive, with only a few complaints. It is important to note that reviews are not necessarily representative of the company. You should check out consumer complaints on each site before deciding which firm to use.

The Better Business Bureau and Consumer Affairs have both given Goldco an A+ rating, and they have received many customer reviews that have been positive. According to the Better Business Bureau, Goldco has received four-star ratings from over 200 consumers. Moreover, the company's customer service is excellent, with most complaints resolved quickly and completely. It is a good sign to know that customers love the way Goldco takes care of the paperwork between the IRA custodian and the storage facility. This eliminates the need to deal with several entities.

The company is well-established and follows IRS rules. However, it prefers the Equity Trust Company as an IRA custodian. Moreover, its customers are allowed to invest without earning income, and they are not required to be over the age limit. As for the IRA rollover, customers can opt to have the precious metals delivered directly to their homes or store them in a vault. It all depends on what you prefer for your gold & silver ira rollover.

Is Birch Gold a legit company? Is it worth investing in their products? The company provides clients with a wide variety of payment methods and investment services. They also give their clients actual custody of the metals they purchase. These customers also have full control over the storage of their precious metals. In addition, there are no reporting requirements associated with purchases. If you're wondering whether Birch Gold is a legitimate company, read on to discover more.

The Birch Gold Group is a twenty-year-old precious metals dealer. The company assists investors with the process of buying, selling, and storing gold. In addition to offering physical metals, the company also facilitates IRA setup. Birch Gold agents are patient in teaching clients about precious metals and when to invest. The company's buy-back promotion offers clients a chance to reap the financial benefits of the physical metals ira while earning an additional income.

The Better Business Bureau is another source to research a company's reputation. The Better Business Bureau is a nonprofit organization focused on advancing marketplace trust. The Better Business Bureau lists over 123 million complaints per year. Those with complaints should contact the Better Business Bureau. The Better Business Bureau has verified consumer reviews and information. It's also worth checking consumer reviews on Birch Gold Group. Its ratings are A+, so it's a safe bet.

If you're unsure whether or not to invest in gold and other precious metals, you should read this Noble Gold review to learn more about the company. This gold investment company is based in Pasadena, California and was founded by two lifelong friends who had seen how the valuable metals market operated without transparency. Unlike some of its competitors, Noble Gold does not try to pressure investors into purchasing their services or purchasing physical assets. Instead, they pride themselves on their professionalism and in-depth knowledge of precious metals. As a customer, you should look forward to receiving timely customer service and reliable electrical company systems.

While the company is new, there are very few cons that compare it to other precious metals providers. The registration process is easy and takes less than 10 minutes. There are also no fees to pay for the first year. In addition, the information provided by Noble Gold is easy to understand. They are also transparent about the charges that you incur for your investments. And because they are still in their early days, you'll get access to their helplines and customer service representatives if you have any questions.

Aside from offering alternative gold and silver coins, Noble Gold offers other forms of investment. Silver Maple Leaf coins, proof American Eagles, and five ounce Highland Mint silver bars are among the most popular choices. In addition to these, the company offers IRA-approved collector coins. Noble Gold also works with three depositories and has Lloyd's of London insurance, which provides peace of mind. However, it is important to understand the risks and benefits of investing in gold and silver.

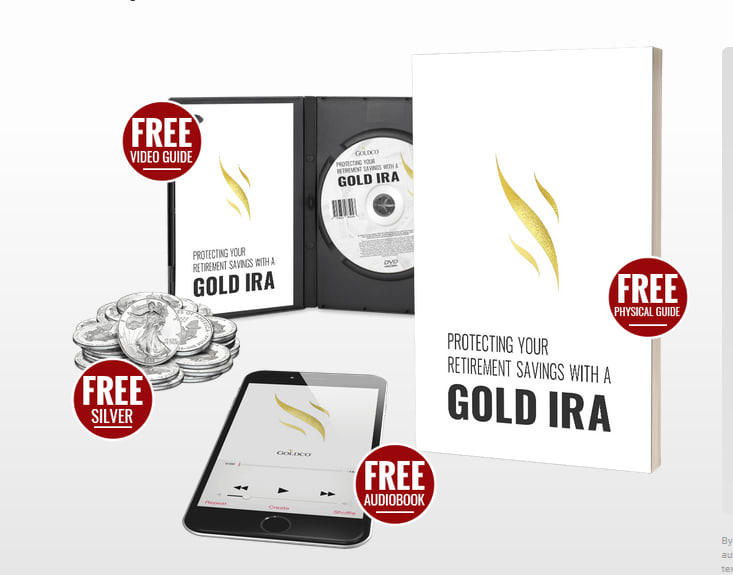

Goldco

Goldco is a leading provider of the precious metals IRA's. They pride themselves in excellent customer service as well the ability in helping individuals to properly diversify your porfolio retirement accounts.

0 comments