Disclosure: The owners of this website may be paid to recommend Gold IRA companies. The content on this website, including any positive reviews and other reviews, may not be neutral or independent.

Unlike a 401(k), an IRA offers investors an unlimited number of investment options. With a 401(k), the investor typically selects from a list of investment options and chooses the one that best suits their needs. However, with an IRA, the investor has unlimited choices and may wish to use the advice of a financial adviser to decide which investment is right for him or her.

Which Gold IRA Company is Best?

Before you invest in gold with a gold IRA company, you should first investigate them. Check their reputation with the Better Business Bureau, the Business Consumer Alliance, or any other independent business review body. You should also look into the company's fees and delivery time. The best companies will not charge you hidden costs, and you should never be asked to pay for a monthly fee that isn't clearly stated.

When comparing gold IRA companies, look for their reputation. Look for companies with an A+ rating from the Better Business Bureau. The Better Business Bureau will allow you to read customer reviews and complaints. The Better Business Bureau also assigns a rating from A+ to F for companies that have a good reputation. Make sure the company has a great reputation before you invest your money with them. These reviews should also help you choose the gold IRA company that is best for you.

While physical precious metals are considered low-risk investments, many people are turning to gold IRA companies because of their diversification benefits. While paper assets can help diversify your portfolio, they have as high a risk as a single investment. You should keep your eye on the strength of the underlying economy. The best gold IRA companies will educate their clients about precious metal IRAs. They will also give you information on how to use these investments to protect your retirement.

Who Has The Best Gold IRA?

There are many different gold IRA accounts available. However, some are better than others. There are also different ways to invest your money. Some of these gold IRAs start at just $25,000, while others require as much as $50k. Regardless of your level of experience, there are many ways to invest in gold.

Goldco - Best Gold IRA Company & Most Trusted

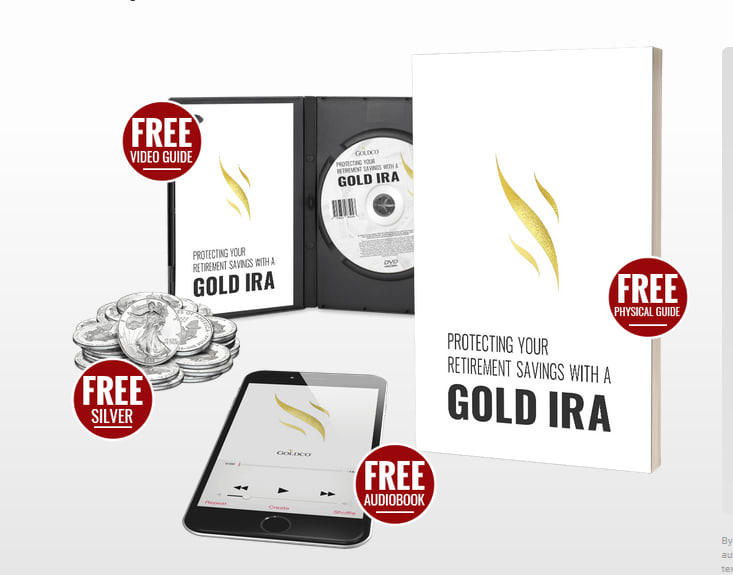

When considering which company offers gold IRAs, you should first consider the reputation of the provider. Goldco is a reputable provider with an A+ rating from the Better Business Bureau. In addition, customers rate Goldco's service highly on Trustpilot. They can help you open a gold IRA or rollover an existing account. Customers can even choose a gold IRA provider that specializes in rollovers.

Another notable feature of Goldco is its guarantee to buy back their precious metals, minus a small administrative fee. IRA investors are also attracted to Goldco's low annual fees, complimentary storage services for precious metals that are not IRA eligible, and tax benefits associated with a gold IRA. All top picks have client education as a key component of their business. If you have questions about the best IRA provider, you can visit their website.

Goldco has an excellent reputation for customer service. Their account managers closely tend to customer needs and are available by phone and online. Account managers take the time to learn about customers' financial goals and recommend appropriate investments. Augusta Precious Metals' transparent pricing also helps their customers. Because their prices are clear, customers know what they're paying. They make the list of the Best Gold IRA Company due to this transparency.

Is Goldco Legitimate?

Goldco is a California-based precious metal firm. They specialize in creating and managing IRAs that use precious metals as part of the investment portfolio. They don't provide their own storage or custodial services, but they have years of experience helping investors invest their money. Their customer service is second to none. Once you submit your information, an agent will contact you to assist you with the process.

Goldco's customer support team can help new and existing customers with account setup and rollovers. They can even check to see if existing accounts are eligible for transfer. They also have a catalog approved by the IRS to store your precious metals. Goldco will provide you with a list of approved metals that you can store in your account, and they will work with you to find a storage facility that meets your needs.

Is Goldco A Reputable Company?

Goldco is a company that takes pride in its customer service. Its clients experience this level of service from the moment they open their accounts. This is evident from its 5-star ratings for service, pricing, and fees. Whether you're in need of storage space or a simple transaction, Goldco has the solution for you. In addition to offering multiple storage options, Goldco offers many incentives, including 5% back in metal on orders over $50,000. And for first-time buyers, the company waives all fees for the first year, which is another reason to choose Goldco.

Another benefit of using Goldco is its self-directed gold IRA. This account acts like a traditional IRA except for the fact that it holds precious metals, such as gold and silver. Goldco allows you to choose from a variety of precious metals that meet IRS quality standards. In addition, you can easily roll over your funds from other retirement accounts into a Goldco gold IRA. In addition to making it easy to transfer funds to the Goldco gold IRA, the company also offers assistance in rolling over your current IRA into a Roth IRA.

Birch Gold Group Offers The Best Selection of Precious Metals

When you want to diversify your retirement portfolio, you may want to consider investing in gold or other precious metals. A precious metal IRA is an excellent way to invest in inflation-resistant assets. Birch Gold Group offers an impressive selection of gold coins and bars. You can also purchase collectible items such as Morgan Silver Dollars and rare pre-1933 coins. Additionally, they offer one of the best buy-back programs in the industry.

Another reason to invest in precious metals is to protect your assets. A company like Birch Gold Group has a reputable track record with the Better Business Bureau (BBB) and is AAA rated by the Business Consumer Alliance (BCA). They also have hundreds of positive reviews on TrustLink. Birch Gold Group also has a four-star rating on Yelp. Regardless of your budget, the company will work with you to find a gold product that best fits your needs and your budget.

When it comes to IRAs, Birch Gold Group offers a variety of services to suit your specific needs. They have specialist resources to help you choose the right metal for your portfolio and can assist you in setting up an account. They also offer personal checks and wire transfers for customers' convenience. Their delivery services are insured and discreet. You can trust their service to protect your investments, and you'll have peace of mind knowing your money is in good hands.

Who Is Birch Gold Group?

The Birch Gold Group has a high standard when it comes to customer empowerment and education, as well as transparency and efficiency. Customers are provided with personalized service and information about the risks and benefits of precious metals investments. They are also provided with guides on how to avoid scams.

For those who want to use self-directed IRA accounts, the Birch Gold Group is an excellent choice. The company explains the process step-by-step. The process is simplified compared to many of the other top precious metal investment companies. The company will assign a precious metals specialist to help you through the process. You can transfer your retirement funds to your account without incurring any penalties, and you can choose to invest in palladium and platinum.

The Birch Gold Group has been in business since 2003, and they have a solid reputation among thousands of customers. They have an A+ Better Business Bureau rating and a AAA Business Consumer Alliance rating. They also have multiple five-star ratings on several websites. They provide a full line of precious metals, from gold and silver to platinum and palladium.

Is Birch Gold A Reputable Company?

Customers who have used Birch Gold's services are very satisfied with the quality of customer service they received. They say that the specialists are very knowledgeable and explain everything clearly. Furthermore, they say that they never felt pressured to purchase anything. As such, they recommend the company.

Augusta Precious Metals - Considered Best For Transparent Pricing

Easy to Save |

|---|

|

Automatic withdrawals |

Matching |

|---|

|

Employer |

Tax Deferrals |

|---|

|

Tax-deferred |

Borrowing for Emergencies |

|---|

|

Potential for |

Augusta has a longstanding reputation for integrity and transparency. The company opened in 2012 and has since earned the highest ratings from the Better Business Bureau (BBB). Their transparent pricing guarantees new customers a 100% money back guarantee and features like guaranteed fair pricing, seven-day price protection, and an excellent buy-back program has made them a favorite among investors and buyers. The company also works with the highly reputable Delaware Depository, which has vault locations across the U.S., and offers a self-directed account with no management fees.

When it comes to transparency and pricing, there's no better option than Augusta Precious Metals. Whether you're investing in augusta gold ira or silver IRA, this company can help you find the right investment for your needs. Not only is Augusta Precious Metals a family-owned business with a long history of transparency, but its pricing is clearly laid out for you to see. The company even includes annual maintenance costs so that you know exactly what you're paying for.

As for the company itself, Augusta has excellent customer service and a stellar track record in gold IRA investments. They've consistently received positive consumer reviews and have been ranked among the best gold IRA firms. But you have to be aware of some drawbacks. The only drawback to Augusta Precious Metals is that it has limited selection of metals. You'll have to invest a significant amount to purchase gold or silver IRAs, and Augusta doesn't offer palladium or platinum. However, the company offers a simple and easy IRA rollover process, which makes it a great choice for investors who want transparency and trustworthiness.

Is Augusta Precious Metals Legit?

Augusta Precious Metals is one of the largest dealers of gold and silver in the United States. It has an A+ rating with the Better Business Bureau. It also offers gold and silver IRAs, which give you full control over your retirement account. This means you won't be affected by fluctuations in the stock market or the government's interest rates.

Augusta Precious Metals also offers educational programs. Its analysts are Harvard-trained. It has also been endorsed by the football player Joe Montana. Moreover, Augusta Precious Metals' customer service is top-notch.

Augusta's Physical Gold And Silver IRA

If you are thinking about opening a gold or silver IRA, there are a few things you need to know before you do. First, make sure the metal you choose meets the IRS' requirements. Then, you must make sure the metals are stored in a regulated Delaware depository. Once you have made the decision, Augusta Precious Metals will help you set up and fund your account. Then, they will ship your precious metals to the Delaware Depository.

Augusta Precious Metals has a stellar customer service record. Their customer service agents are available to answer any questions you might have. They also provide a wide range of educational videos and a helpful FAQ page. Their team also offers unique insights into the world of precious metals. You won't be left alone when it comes to paperwork - Augusta Precious Metals claims to handle 95% of it for you.

Noble Gold Offers The Best Tools And Knowledge To Help You Make The Right Investment Decisions

Easy to Save |

|---|

|

Automatic withdrawals |

Matching |

|---|

|

Employer |

Tax Deferrals |

|---|

|

Tax-deferred |

Borrowing for Emergencies |

|---|

|

Potential for |

If you're looking for the best way to invest in precious metals, Noble Gold is the place to go. Their team is comprised of experienced precious metals investors and they provide tools and knowledge to help you make the right investment decision. The entire process is personalized and the company puts its clients' needs first. Read on to learn more about Noble Gold and its advantages. You'll be glad you did. The company has an A+ rating with the Better Business Bureau and 30 employees in Pasadena, California.

Noble Gold is extremely easy to use. Setting up an account is quick and easy, and their representatives offer support and professional advice. While they may only be in business since 2017, their fees are competitive and transparent. You can expect to pay around $80 annually for a Noble Gold IRA, and between $150 and $225 for storage. For advanced investors, their Royal Survivals packs come with no annual fees, but requires a much higher investment.

Is Noble Gold A Legitimate Company?

Noble Gold is based in Pasadena, California. It was founded by two lifelong friends who saw the lack of transparency and profiteering in the valuable metals market. It prides itself on its honesty and knowledge of the precious metals market. They also believe in a long-term investment strategy.

The company offers a variety of precious metals, including bullion and specialized coins, such as government-approved Palladium coins. It also stores precious metals. It has storage facilities in Canada and Delaware. It also offers Royal Survival Packs, which maintain their value in times of disaster.

The company also has a dedicated customer service team that works to answer questions and ensure their customers are well-served. This makes it easier for clients to protect their funds. Noble Gold also provides photographic proof of every precious metal purchase. The company has helped clients secure over $200 million in investments in precious metals.

Advantage Gold - Most Reliable And Trustworthy Company

Easy to Save |

|---|

|

Automatic withdrawals |

Matching |

|---|

|

Employer |

Tax Deferrals |

|---|

|

Tax-deferred |

Borrowing for Emergencies |

|---|

|

Potential for |

If you are looking for a reliable and trustworthy company to handle your IRA, you should read some customer reviews first. You can find over 900 on TrustPilot, and they have a perfect 5-star rating. You can also check the BBB's website, which has more than 25 reviews of Advantage Gold. Thankfully, this company has a great track record, as only one complaint has been filed in the last three years.

The team at Advantage Gold prides itself on exceptional customer service and transparent pricing. They educate new and potential customers, and they help them navigate the complexities of investing in physical precious metals. With their award-winning services, they are consistently attracting 5-star reviews and ratings on reputable review sites. In fact, more than 90 percent of reviews are five stars! Read on to learn more about Advantage Gold's services.

Is Advantage Gold A Good Company?

A company is a good investment when it has good customer reviews, but is Advantage Gold one of them? The company was ranked the best Gold IRA company by Trustlink for 5 consecutive years. In addition, it has great ratings from the BBB and Business Consumer Alliance. It is an accredited member of both organizations and boasts an A+ rating with the Better Business Bureau. Furthermore, it has received an AAA rating from the Business Consumer Alliance. However, these reviews are not yet enough to determine the company's worthiness.

The Advantage Gold website is easy to navigate and offers basic information about gold IRAs. It even guides customers through the process of setting up their IRA account. It also waives the delivery fees and initial-year charge for new accounts. It also offers a free hardcover book to new investors. Before opening an account, it is necessary to learn more about the company's services and fees and to familiarize yourself with its products.

Regal Assets - Best Known For Customer Support And Low-Pressure Sales Style

Easy to Save |

|---|

|

Automatic withdrawals |

Matching |

|---|

|

Employer |

Tax Deferrals |

|---|

|

Tax-deferred |

Borrowing for Emergencies |

|---|

|

Potential for |

When it comes to investing, Regal Assets is a notable name in the space. They specialize in non-traditional investments and partner with reputable trading firms. Their cryptocurrency section, known as "Regal Wallet," helps investors understand how to invest in cryptocurrencies. The company is known for its customer support and low-pressure sales style. The team is comprised of financial experts with decades of experience, and Gallagher has been featured on Forbes' Finance Council for a few years.

Among the other things Regal Assets is known for are their IRA products and services. Gold IRAs and cryptocurrency IRAs are just a few of the options available. These investments are accessible to all, no matter their level of experience. While they may not be as widely known as stocks and bonds, they are valuable and offer many benefits. If you are considering investing in gold or cryptocurrency, you may be wondering what you can expect.

What Are Regal Assets?

If you are looking for a secure way to invest your money, consider using a service like Regal Assets. They offer a number of IRA approved bullion options, as well as a number of cryptocurrency options. While the company earns a high commission on each sale, it respects the investor's autonomy and does not push customers into specific investment areas. Another benefit of working with them is the seven-day money-back guarantee on purchases.

The company is well-reviewed by its customers and has an impressive reputation. It has a AAA rating from the Business Consumer Alliance and has received good ratings from several consumer review sites. Its website states that it has validated its reviews with Trustlink, and its staff has validated email addresses and phone numbers to verify that the customers are genuinely satisfied with their experience.

Goldco

Goldco is a leading provider of the precious metals IRA's. They pride themselves in excellent customer service as well the ability in helping individuals to properly diversify your porfolio retirement accounts.

0 comments